How Artificial Intelligence is Revolutionizing Accounting in 2025

Artificial Intelligence (AI) has become a powerful force transforming various industries, and accounting is no exception. Known traditionally for its manual and detail-oriented processes, accounting is experiencing a revolution with the help of AI. This article explores how AI is impacting the accounting field, its benefits, applications, challenges, and the promising future it holds for finance professionals.

What is AI in Accounting?

AI in accounting refers to the use of advanced technology, including machine learning (ML), robotic process automation (RPA), and natural language processing (NLP), to automate tasks, analyze data, and enhance decision-making. These technologies allow accountants to process large amounts of data quickly, identify patterns, and provide valuable insights into financial trends.

Key Technologies in AI for Accounting

- Machine Learning (ML): ML algorithms help in processing and analyzing complex datasets to reveal hidden patterns, which aids in predictive analytics and decision-making.

- Robotic Process Automation (RPA): RPA automates repetitive tasks, such as data entry and invoice processing, reducing human involvement in time-consuming activities.

- Natural Language Processing (NLP): NLP enables AI systems to interpret and process human language, which is helpful for functions like financial analysis and report generation.

Benefits of AI in Accounting

AI offers a range of benefits in the accounting field, from automating routine tasks to providing advanced insights for decision-making.

1. Efficiency and Automation

One of the greatest benefits AI brings to accounting is its ability to streamline workflows by automating routine and repetitive tasks. Data entry, invoice processing, and report generation can be completed by AI-powered tools faster than any human. This automation allows accountants to focus on more strategic roles that require critical thinking.

2. Accuracy and Error Reduction

AI excels at handling large datasets with remarkable accuracy. Unlike humans, AI systems don’t suffer from fatigue or distraction, which means they can reduce errors in complex tasks. By improving accuracy, AI enhances the reliability of financial data, making it easier for accountants to produce precise reports.

3. Cost Savings

By automating tasks and improving efficiency, AI enables accounting firms to save significant amounts of money. Operational costs can be reduced as fewer human resources are needed for manual processes. Additionally, fewer errors mean less money spent on correcting mistakes, which can be costly for companies.

4. Predictive Analysis and Decision Making

AI’s ability to analyze trends and historical data allows it to make predictions about future financial outcomes. This capability is invaluable for forecasting revenue, planning budgets, and developing strategies. By providing insights into future trends, AI helps businesses make proactive decisions.

AI Applications in Accounting

Artificial Intelligence is reshaping accounting with powerful applications that enhance efficiency, reduce errors, and enable insightful decision-making. Below are key areas where AI is making a significant impact, along with examples of tools and resources to get started.

1. Automated Data Entry and Processing

Data entry has always been a tedious, manual task in accounting. AI-powered Robotic Process Automation (RPA) tools streamline this process, automating data entry to save accountants hours of repetitive work and reducing human error.

Example:

Website:uipath.com

Description: UiPath uses RPA to automate routine tasks such as data entry, invoice processing, and more, helping firms maintain accurate records and allowing accountants to focus on strategic work.

Example:

Website:automationanywhere.com

Description: This RPA tool is designed for end-to-end automation, from data entry to document processing, enabling businesses to scale operations without a proportional increase in labor costs.

2. Expense Management

AI tools can categorize and analyze expenses automatically, learning from previous transactions to make accurate classifications. This capability simplifies tracking and managing expenses, especially for businesses with frequent or high-volume transactions.

Example:

Website:expensify.com

Description: Expensify automates expense reporting by categorizing receipts and transactions, making it easier for accountants to track business spending accurately.

Example:

Website:xero.com

Description: Xero leverages AI for expense management, providing features for real-time expense tracking, automatic categorization, and integrated payment reconciliation.

3. Financial Reporting and Auditing

Financial reporting is a critical part of accounting that requires accuracy. AI tools can streamline report generation and ensure data correctness, detecting discrepancies for audits and ensuring that reports are complete and compliant.

Example:

Website:mindbridge.ai

Description: MindBridge uses AI and machine learning to detect anomalies and errors in financial data, providing invaluable support for audits by highlighting potential issues.

Example:

Website:blackline.com

Description: BlackLine’s AI-driven platform automates financial close and reporting processes, ensuring accuracy and compliance in financial statements.

4. Fraud Detection and Risk Management

AI algorithms can detect unusual patterns in financial data that may indicate fraud. Machine learning allows these tools to analyze trends and identify potential risks, helping accountants mitigate threats before they escalate.

Example SAS Tool:

Website:sas.com

Description: This tool uses machine learning to monitor transactional data for fraud indicators, alerting accountants to suspicious activities and enabling real-time fraud prevention.

Example:

Website:thetaray.com

Description: ThetaRay employs AI for risk management, utilizing anomaly detection to identify financial crime patterns that traditional rule-based systems may miss.

5. Predictive Analytics for Financial Forecasting

AI can analyze historical data to forecast future trends, aiding financial planning and strategy. This predictive capability is beneficial for budgeting, cash flow analysis, and investment planning.

Example:

Website:fathomhq.com

Description: Fathom provides visual financial analysis and forecasting tools that leverage AI to predict financial outcomes based on historical data, helping businesses plan with precision.

Example:

Website:planful.com

Description: Planful’s AI-powered platform offers forecasting, budgeting, and financial modeling tools that assist accounting teams in making informed decisions with accurate projections.

Challenges of Implementing AI in Accounting

Despite the advantages, AI adoption in accounting does come with challenges. Recognizing and addressing these issues can help firms prepare for a successful implementation.

1. High Initial Costs

The financial investment required for AI adoption includes software, hardware, and training expenses, which may be challenging, particularly for smaller firms. Over time, however, costs are expected to decrease as AI technology becomes more accessible.

Solution Tip: Start small with AI tools that offer scalable options, like QuickBooks Online, which provides affordable automation features for smaller businesses.

Website:quickbooks.intuit.com

2. Data Privacy and Security Concerns

With AI heavily reliant on data, there’s a heightened risk of cybersecurity threats and data breaches. Safeguarding sensitive financial information is crucial to maintaining client trust and regulatory compliance.

Solution Tip: Use AI tools with built-in security features, such as IBM Security Guardium, which monitors and protects sensitive data in real time.

Website:ibm.com/security/guardium

3. Skill Gap and Workforce Transformation

Adopting AI in accounting requires new skills, such as data analytics and familiarity with AI tools. Bridging this skill gap involves training accountants in technical skills to work effectively with AI systems.

Solution Tip: Offer training programs through platforms like Coursera and Udacity, which provide AI and data analytics courses tailored for accounting professionals.

Coursera Website:coursera.org

Udacity Website:udacity.com

4. Dependence on High-Quality Data

AI systems are only as effective as the data they are fed. Low-quality data can lead to inaccurate predictions and poor insights, which can adversely affect decision-making processes.

Solution Tip: Use data-cleansing tools like Talend to ensure data accuracy before feeding it into AI systems.

Website:talend.com

This list of tools and practical advice provides accounting professionals with a roadmap to effectively integrate AI, tackle common challenges, and harness the full potential of artificial intelligence in accounting.

Future of AI in Accounting

The future of AI in accounting looks promising, with many advancements expected to transform the industry further.

Predicted Growth and Advancements

AI technology is continuously evolving, and its role in accounting is only expected to grow. In the coming years, AI could become a standard tool in accounting practices, helping firms increase productivity and reduce operational costs. Moreover, advancements in machine learning and NLP could make AI even more sophisticated, enabling it to handle more complex accounting tasks.

Impact on Accounting Jobs

While some fear that AI could replace human jobs in accounting, it’s more likely that it will change the nature of these jobs. Routine tasks may become fully automated, but this will allow accountants to focus on more value-added activities, such as strategic planning and advisory roles. The demand for accountants with tech-savvy skills will increase, making it essential for professionals to adapt to these changes.

Required Skills for the Future Accountant

With AI integration, accountants will need to acquire skills beyond traditional accounting knowledge. Data analytics, programming basics, and a good understanding of AI technologies will become increasingly valuable. Upskilling in these areas can help accountants stay relevant in a technology-driven environment.

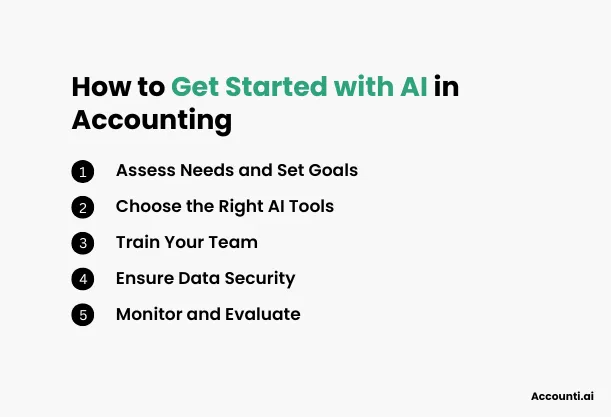

How to Get Started with AI in Accounting

For firms considering the integration of AI, here’s a step-by-step approach to help ease the transition.

1. Assess Needs and Set Goals

Identify the areas within your accounting processes that could benefit from AI. Are you looking to automate data entry? Improve forecasting? Define your goals to ensure that the chosen AI solutions align with your needs.

2. Choose the Right AI Tools

There are various AI tools designed for specific accounting functions. Do your research to find software that meets your requirements. Some popular options include Xero, QuickBooks, and Sage, which offer AI-driven features for expense management, forecasting, and more.

3. Train Your Team

Successful AI implementation requires that your team understand how to use the technology effectively. Invest in training programs to equip your staff with the skills needed to operate AI tools and interpret AI-driven insights.

4. Ensure Data Security

As AI relies on vast amounts of data, prioritizing data security is essential. Implement strong cybersecurity measures to protect sensitive financial information and comply with data protection regulations.

5. Monitor and Evaluate

Once you’ve implemented AI, monitor its impact on your accounting processes. Collect feedback, evaluate performance, and make adjustments as needed. This will help you refine your approach and ensure that you are getting the maximum benefit from AI.

Conclusion

Artificial Intelligence is revolutionizing the accounting industry by automating tasks, improving accuracy, and offering valuable insights for decision-making. While there are challenges to adopting AI, such as high costs and the need for data security, the benefits make it a worthwhile investment for many accounting firms. As AI technology continues to evolve, its applications in accounting will likely expand, creating new opportunities for professionals and transforming how the industry operates.

Frequently Asked Questions (FAQs)

Will accounting be replaced by artificial intelligence?

Artificial intelligence is transforming the accounting industry, but it's unlikely to completely replace human accountants. AI can automate repetitive tasks like data entry, expense management, and audit processes, improving efficiency and accuracy. However, accounting still requires critical thinking, decision-making, and complex problem-solving, which are skills best suited to humans. Rather than replacing accountants, AI is expected to augment their roles, allowing them to focus on higher-value tasks such as financial analysis, strategy, and advising clients.

How AI is revolutionizing finance?

AI is revolutionizing finance by enhancing decision-making, streamlining operations, and boosting risk management. In finance, AI-driven algorithms analyze vast data sets to predict market trends, optimize investments, and assess credit risk. Automated processes, like robo-advisors and chatbots, provide 24/7 financial guidance to users. Furthermore, AI-powered fraud detection systems analyze transactions in real-time to flag suspicious activity, reducing fraud risks. Overall, AI is driving efficiency, accuracy, and customer satisfaction in the finance industry, transforming how financial institutions operate and interact with clients.

How artificial intelligence is revolutionizing business?

Artificial intelligence is revolutionizing business across industries by automating tasks, personalizing customer experiences, and driving data-based insights. AI enables companies to streamline operations, improve customer service with chatbots, and optimize marketing strategies through predictive analytics. In manufacturing, AI improves quality control and predictive maintenance. In retail, it helps in demand forecasting and personalized shopping experiences. By automating routine tasks and providing valuable insights, AI allows businesses to become more efficient, innovative, and competitive in the modern market.

How is AI transforming the accounting industry and what will the future look like?

AI is transforming the accounting industry by automating routine tasks, enhancing data accuracy, and improving decision-making processes. Current AI applications in accounting include automated bookkeeping, tax preparation, invoice processing, and audit functions. With AI, accountants can focus more on strategic advisory roles, providing insights based on data-driven analysis. The future of accounting will likely see increased collaboration between humans and AI, with AI taking over manual and repetitive tasks while accountants handle complex judgment-based activities. This shift will redefine the accountant's role as more consultative and analytics-focused, adding significant value for clients.

Will AI replace ACCA?

AI is unlikely to replace ACCA (Association of Chartered Certified Accountants) professionals. While AI can automate many accounting tasks, it cannot fully replicate the expertise and judgment of certified accountants. ACCA professionals are trained in complex financial and strategic decision-making, ethics, and client management—areas where human expertise remains essential. Instead, AI will likely complement ACCA professionals, helping them work more efficiently by handling time-consuming tasks, allowing accountants to focus on higher-level, value-added services. For ACCA members, adapting to AI advancements is an opportunity to expand their roles rather than face replacement.

How can AI be used in accounting?

AI can be used in accounting to automate data entry, categorize expenses, manage invoices, and detect anomalies or fraud. Machine learning algorithms can analyze patterns in financial data to streamline audits and ensure compliance with regulations. AI-powered tools can also assist in financial forecasting, helping businesses make informed decisions by analyzing market trends and internal data. Additionally, chatbots driven by AI can support customer service within accounting firms, answering frequently asked questions and managing client inquiries. Through these applications, AI enables accountants to save time, reduce errors, and focus on strategic advisory roles.

Rohit Kapoor

Rohit Kapoor