A Beginner’s Guide to Bank Reconciliation: How to Keep Your Finances in Check

Have you ever wondered if your bank account balance matches what you think it should be? That's where bank reconciliation comes in handy. In this article, we'll dive deep into the world of bank reconciliation, exploring its importance and guiding you through the process step by step.

Bank reconciliation is the process of comparing your internal financial records with your bank statement to ensure they match up. It's a crucial task for both businesses and individuals, helping to maintain accurate financial records and catch any discrepancies or errors.

But when should you perform a bank reconciliation? Well, it's generally recommended to reconcile your accounts at least once a month, coinciding with your bank statement cycle. However, some businesses might opt for more frequent reconciliations, especially if they have a high volume of transactions.

Now, let's roll up our sleeves and dive into the nitty-gritty of bank reconciliation!

What is Bank Reconciliation?

Bank reconciliation is like being a financial detective. It's the process of comparing your internal financial records (often called your ledger or books) with the records your bank has (your bank statement). The goal? To make sure every penny is accounted for and everything adds up correctly.

Key components involved in bank reconciliation include:

- Your bank statement

- Your internal ledger or accounting records

- A list of outstanding checks and deposits

- Any bank fees or interest earned

Think of it as a financial puzzle where all the pieces need to fit perfectly together.

Why is Bank Reconciliation Important?

You might be wondering, "Is all this reconciliation really necessary?" The answer is a resounding yes! Let's explore why:

Detecting Errors and Discrepancies

Imagine you're balancing your checkbook (if you still do that!) and notice you're $100 short. Without reconciliation, you might never catch that the bank accidentally withdrew $100 extra from your account. Bank reconciliation helps you spot these errors quickly.

Preventing Fraud and Unauthorized Transactions

In today's digital age, financial fraud is unfortunately common. Regular reconciliation can help you catch unauthorized transactions early, potentially saving you from significant financial loss.

Ensuring Accurate Financial Records

For businesses, accurate financial records are crucial for making informed decisions, filing taxes correctly, and maintaining the trust of investors and stakeholders. For individuals, it helps you stay on top of your personal finances and avoid overdraft fees or bounced checks.

Steps to Perform a Bank Reconciliation

Now that we understand the importance of bank reconciliation, let's walk through the process step by step.

Gathering Necessary Documents

Before you start, make sure you have these essential documents at hand:

- Your most recent bank statement

- Your internal ledger or accounting records

- A list of outstanding checks and deposits

- Any relevant receipts or transaction records

Comparing Bank Statements with Your Ledger

This is where the real detective work begins. Here's how to do it:

- Start with your ledger balance at the beginning of the period.

- Add any deposits or credits recorded in your ledger.

- Subtract any checks or debits recorded in your ledger.

- Compare this ending balance with the ending balance on your bank statement.

At this point, it's likely that the two balances won't match exactly. Don't worry! This is normal and is usually due to timing differences between when transactions are recorded in your books and when they clear the bank.

Identifying Discrepancies

Now, it's time to play spot the difference. Common discrepancies include:

- Outstanding checks: Checks you've written but haven't cleared the bank yet.

- Deposits in transit: Deposits you've recorded but haven't been processed by the bank yet.

- Bank fees: Charges from the bank that you might not have recorded.

- Interest earned: Interest added to your account that you might not have recorded.

To investigate discrepancies:

- Check each transaction on your bank statement against your ledger.

- Make a list of any transactions that appear in one place but not the other.

- Determine the reason for each discrepancy (timing difference, error, or fraud).

Adjusting the Ledger

Once you've identified all discrepancies, it's time to make adjustments to your ledger. Here are some common adjustments:

- Recording bank fees and interest earned

- Correcting any errors in your ledger

- Noting NSF (non-sufficient funds) checks

For example, if you find a bank fee of $20 on your statement that you hadn't recorded, you'd make an entry in your ledger to decrease your balance by $20.

Confirming the Reconciliation

The final step is to ensure that both balances match. Here's how:

- Start with the ending balance on your bank statement.

- Add any deposits in transit.

- Subtract any outstanding checks.

- The result should equal your adjusted ledger balance.

If the balances still don't match, don't panic! Go back through your work step by step. Check your math, review for missed transactions, and double-check your adjustments. Persistence is key!

Tools and Software for Bank Reconciliation

In today's digital age, you have options when it comes to how you perform bank reconciliation.

Manual vs. Automated Reconciliation

Manual Reconciliation:

- Pros:

- Gives you a detailed understanding of your finances

- Can be more accurate for small businesses or individuals with few transactions

- Cons:

- Time-consuming

- More prone to human error

Automated Reconciliation:

- Pros:

- Saves time

- Reduces human error

- Can handle large volumes of transactions easily

- Cons:

- May miss nuanced discrepancies that a human would catch

- Can be expensive for small businesses or individuals

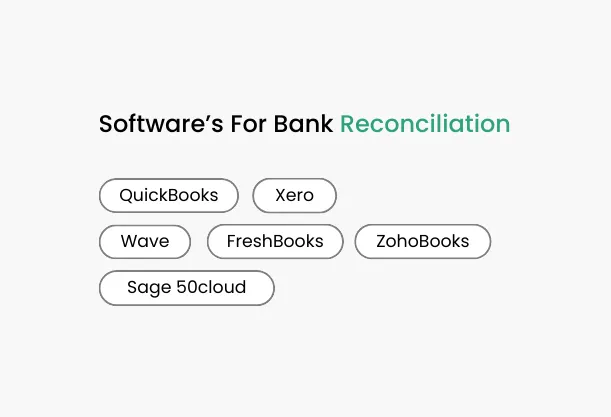

Recommended Software Tools

If you decide to go the automated route, here are some popular reconciliation tools:

When choosing reconciliation software, look for features like:

- Bank feed integration

- Automatic transaction categorization

- Easy-to-use interface

- Robust reporting capabilities

- Cloud-based access

Remember, the best tool for you depends on your specific needs and the size of your business or personal finances.

Common Challenges and Solutions

Even with the best tools and practices, you might encounter some bumps along the reconciliation road.

Handling Common Reconciliation Issues

Here are some common challenges and how to overcome them:

- Missing Transactions:

- Transposition Errors:

- Duplicate Entries:

- Timing Differences:

Solution: Carefully review all documentation and reach out to the bank if necessary.

Solution: Use a calculator and double-check your entries.

Solution: Implement a system to mark transactions as reconciled to avoid duplicates.

Solution: Keep detailed records of outstanding checks and deposits in transit.

Tips for Smooth Reconciliation

To make your reconciliation process as smooth as possible:

- Reconcile frequently (at least monthly)

- Keep detailed, organized records

- Use a consistent method or system

- Address discrepancies immediately

- Consider using accounting software for automation

- Separate personal and business finances

- Maintain open communication with your bank

By following these tips, you'll be well on your way to mastering the art of bank reconciliation!

Conclusion

Bank reconciliation might seem like a daunting task at first, but it's an essential practice for maintaining financial health and accuracy. By following the steps outlined in this guide, you can ensure that your financial records are always in top shape.

Remember, reconciliation is not just about matching numbers—it's about understanding your financial story. It helps you catch errors, prevent fraud, and make informed financial decisions. Whether you're running a business or managing personal finances, regular bank reconciliation is a habit that pays off.

So, grab those bank statements, fire up your ledger, and start reconciling. Your future self (and your accountant) will thank you!

Rohit Kapoor

Rohit Kapoor