How to Calculate Accumulated Depreciation: Step-by-Step Guide

Depreciation is a fundamental concept in accounting that plays a crucial role in financial reporting and asset management.

Understanding how to calculate accumulated depreciation is essential for businesses of all sizes, as it directly impacts financial statements and tax obligations.

In this article, we'll dive deep into the world of depreciation, explore various calculation methods, and provide you with a step-by-step guide to mastering accumulated depreciation.

What is Depreciation?

Depreciation is an accounting method used to allocate the cost of a tangible asset over its useful life. It represents the gradual decrease in an asset's value due to wear and tear, obsolescence, or the passage of time. There are several types of depreciation methods, each suited to different asset types and business needs.

Understanding Accumulated Depreciation

Accumulated depreciation is the total amount of depreciation expense recorded for an asset since its acquisition. It's a contra-asset account that reduces the book value of the asset on the balance sheet. Understanding the difference between depreciation expense and accumulated depreciation is crucial:

- Depreciation expense is the amount of depreciation charged for a single accounting period.

- Accumulated depreciation is the total sum of depreciation expenses over time.

Methods of Calculating Depreciation

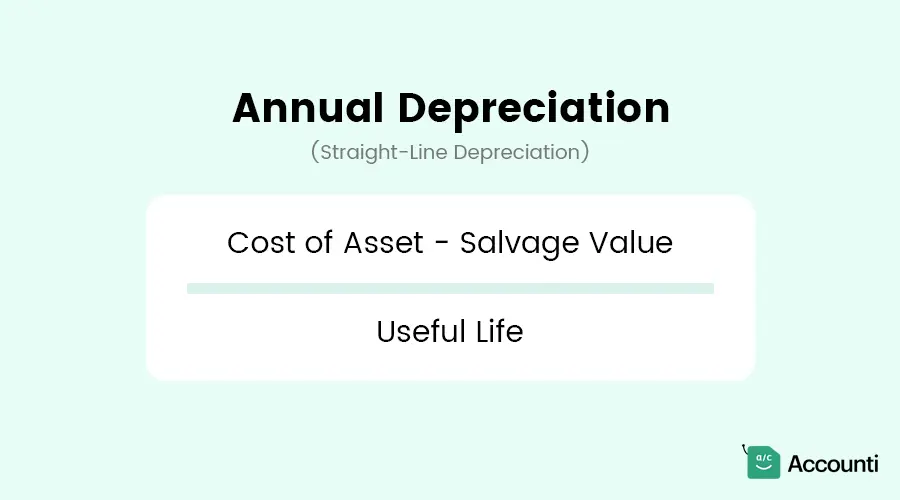

Straight-Line Depreciation

The straight-line method is the simplest and most commonly used depreciation method. It assumes that an asset loses its value evenly over its useful life.

Example: A machine costs $10,000, has a salvage value of $2,000, and a useful life of 5 years.

Annual Depreciation = ($10,000 - $2,000) / 5 = $1,600 per year

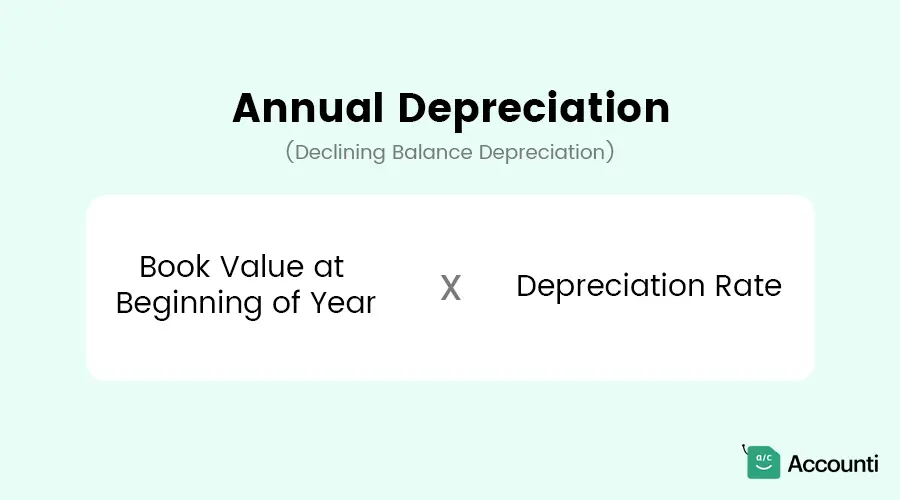

Declining Balance Depreciation

This method accelerates depreciation, resulting in higher depreciation expenses in the early years of an asset's life and lower expenses in later years.

Example: Using a 200% declining balance for the same machine:

Year 1: $10,000 x (2/5) = $4,000

Year 2: $6,000 x (2/5) =

$2,400

Year 3: $3,600 x (2/5) = $1,440 And so on...

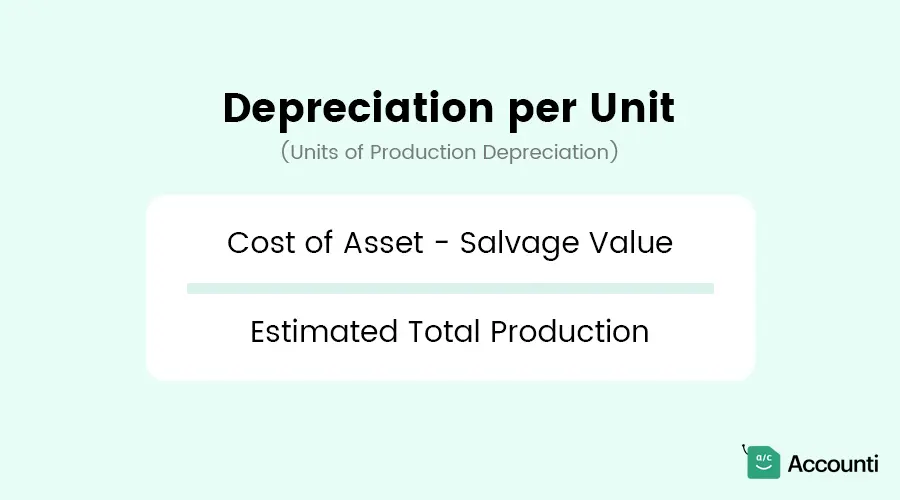

Units of Production Depreciation

This method bases depreciation on the actual usage of an asset, making it ideal for assets whose usage varies significantly from year to year.

Annual Depreciation = Depreciation per Unit x Units Produced in the Year

Example: A machine costs $50,000, has a salvage value of $5,000, and is expected to produce 100,000 units over its lifetime.

Depreciation per Unit = ($50,000 - $5,000) / 100,000 = $0.45 per unit

If 20,000 units are produced in Year 1, the depreciation would be: 20,000 x $0.45 = $9,000

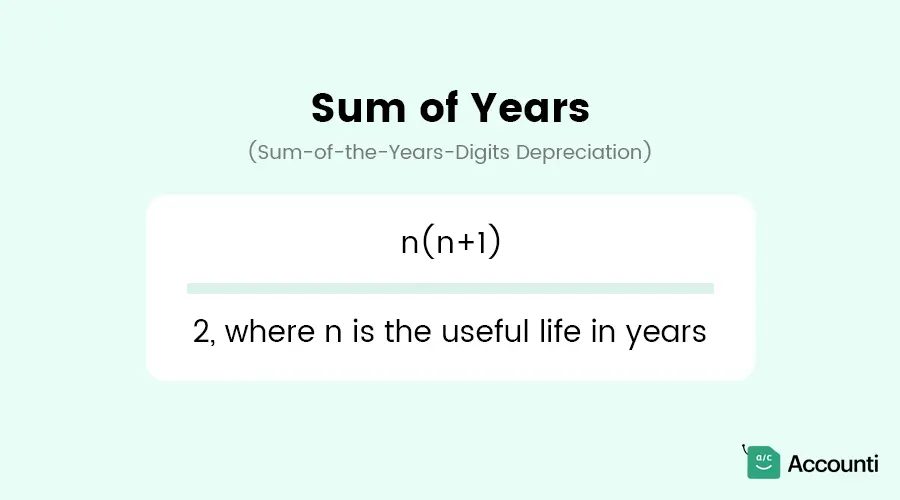

Sum-of-the-Years-Digits Depreciation

This accelerated depreciation method allocates a higher depreciation expense in the early years of an asset's life, gradually decreasing over time.

Annual Depreciation = (Remaining Life / Sum of Years) x (Cost - Salvage Value)

Example: For an asset with a 5-year useful life:

Sum of Years = 5(5+1)/2 = 15

Year 1: (5/15) x ($10,000 - $2,000) = $2,667

Year 2: (4/15)

x ($10,000 - $2,000) = $2,133

Year 3: (3/15) x ($10,000 -

$2,000) = $1,600 And so on...

Step-by-Step Guide to Calculate Accumulated Depreciation

- Determine the initial cost of the asset: Include purchase price and any costs to prepare the asset for use.

- Estimate the useful life of the asset: Consider factors like expected wear and tear, technological obsolescence, and industry standards.

- Determine the salvage value: Estimate the asset's worth at the end of its useful life.

- Choose a depreciation method: Select the most appropriate method based on the asset type and your business needs.

- Calculate annual depreciation: Use the chosen method to compute yearly depreciation.

- Sum up the annual depreciation: Add up all the annual depreciation amounts to get the accumulated depreciation.

Example Calculations

Let's compare the accumulated depreciation after 3 years for our $10,000 machine with a $2,000 salvage value and 5-year useful life using different methods:

- Straight-Line: $1,600 x 3 = $4,800

- Declining Balance (200%): $4,000 + $2,400 + $1,440 = $7,840

- Sum-of-the-Years-Digits: $2,667 + $2,133 + $1,600 = $6,400

Note how accelerated methods result in higher accumulated depreciation in the early years.

Factors Affecting Depreciation

Several factors can influence depreciation calculations:

- Asset type: Different assets may depreciate at different rates.

- Usage and maintenance: Heavy use or poor maintenance can accelerate depreciation.

- Technological changes: Rapid advancements may shorten an asset's useful life.

- Market conditions: Economic factors can affect an asset's value over time.

Importance of Accumulated Depreciation in Financial Statements

Accumulated depreciation plays a crucial role in financial reporting:

Impact on Balance Sheet

Accumulated depreciation is subtracted from the asset's original cost to show its net book value, providing a more accurate representation of the company's assets.

Impact on Income Statement

Depreciation expense reduces reported earnings, affecting profitability metrics and potentially influencing investor perceptions.

Tax Implications

Depreciation can be used as a tax deduction, reducing taxable income and lowering tax liability.

Common Mistakes and How to Avoid Them

- Incorrect estimation of useful life: Regularly review and adjust estimates based on actual asset performance and industry standards.

- Ignoring salvage value: Always consider the potential residual value of an asset at the end of its useful life.

- Changing methods mid-way: Consistency is key. Changing depreciation methods without proper justification can lead to financial reporting issues.

Conclusion

Calculating accumulated depreciation is a critical skill for financial professionals and business owners alike. By understanding the various methods and following a systematic approach, you can ensure accurate financial reporting and make informed decisions about asset management. Remember that depreciation is not just an accounting exercise-it's a powerful tool for understanding the true value of your business assets over time.

FAQs

What is the formula for an accumulated amount in Excel?

To calculate accumulated depreciation in Excel, you can use the SUM function to add up all the annual depreciation amounts. For example: =SUM(B2:B6) would sum up the depreciation values in cells B2 through B6.

What is the difference between depreciation and amortization?

Depreciation applies to tangible assets (like equipment or vehicles), while amortization applies to intangible assets (like patents or copyrights). The calculation methods are similar, but they're used for different types of assets.

How often should depreciation be calculated?

Depreciation is typically calculated and recorded at least annually for financial reporting purposes. However, many businesses calculate it monthly or quarterly for more accurate interim financial statements.

How do you calculate accumulated deficit?

Accumulated deficit is different from accumulated depreciation. It represents the cumulative net losses of a company over time. To calculate it, sum up all net losses (or subtract net income) from the beginning of the company's operations.

What is the formula for accumulated depreciation straight line example?

For straight-line depreciation, the formula is: Accumulated Depreciation = (Cost - Salvage Value) x (Current Age / Useful Life). For example, if an asset cost $10,000, has a salvage value of $2,000, a useful life of 5 years, and is currently 3 years old, the accumulated depreciation would be: ($10,000 - $2,000) x (3/5) = $4,800.

How does accumulated depreciation affect cash flow?

Accumulated depreciation doesn't directly affect cash flow, as it's a non-cash expense. However, it can indirectly impact cash flow through tax implications, as depreciation expenses can reduce taxable income, potentially lowering tax payments.

Rohit Kapoor

Rohit Kapoor