How to Accurately Calculate Burn Rate and Extend Your Startup’s Cash Runway

Burn rate is a crucial financial metric that measures how quickly a company is spending its cash reserves over a specific period, typically monthly.

It's the rate at which a company is losing money, particularly when the company's expenses exceed its revenues.

Importance of Understanding Burn Rate for Businesses

Understanding burn rate is vital for businesses, especially startups, for several reasons:

- It helps predict how long a company can operate before running out of cash

- It informs financial planning and budgeting decisions

- It's a key indicator of a company's financial health and sustainability

- It influences investor interest and funding decisions

Why Burn Rate is a Key Financial Metric

Burn rate serves as a critical financial metric because it:

- Provides insight into a company's cash management

- Helps in forecasting future funding needs

- Indicates the company's runway (how long it can operate before needing additional funding)

- Reflects the company's operational efficiency

Reasons Startups Monitor Burn Rate

Startups closely monitor their burn rate for the following reasons:

- To ensure they have enough cash to reach important milestones

- To make informed decisions about cost-cutting or revenue-generating initiatives

- To determine when to start fundraising efforts

- To demonstrate financial responsibility to investors

- To compare their financial performance against industry benchmarks

Types of Burn Rate

There are two primary types of burn rate: Gross Burn Rate and Net Burn Rate.

Gross Burn Rate

Gross burn rate represents the total amount of cash a company spends each month on operating expenses.

Formula: Gross Burn Rate = Total Monthly Expenses

For example, if a startup spends $50,000 on salaries, $10,000 on rent, and $5,000 on other expenses in a month, its gross burn rate would be:

$50,000 + $10,000 + $5,000 = $65,000 per month

Here's a chart showing how gross burn rate might fluctuate based on different expenses:

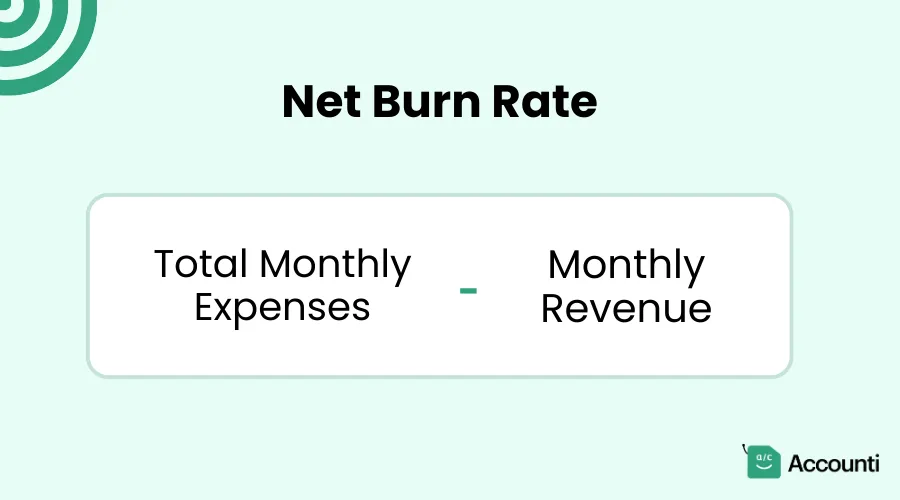

Net Burn Rate

Net burn rate is the rate at which a company is losing money. It takes into account both expenses and revenue.

Formula: Net Burn Rate = Total Monthly Expenses - Monthly Revenue

For instance, if the same startup from our previous example has a monthly revenue of $40,000, its net burn rate would be:

$65,000 - $40,000 = $25,000 per month

Comparison: Gross Burn Rate vs. Net Burn Rate

Here's a table highlighting the key differences between gross and net burn rates:

|

Aspect |

Gross Burn Rate |

Net Burn Rate |

|

Definition |

Total monthly expenses |

Monthly expenses minus revenue |

|

Formula |

Total Monthly Expenses |

Total Monthly Expenses - Monthly Revenue |

|

What it shows |

Total cash outflow |

Actual cash loss |

|

Considers revenue |

No |

Yes |

|

Use case |

Understanding total operational costs |

Determining actual financial sustainability |

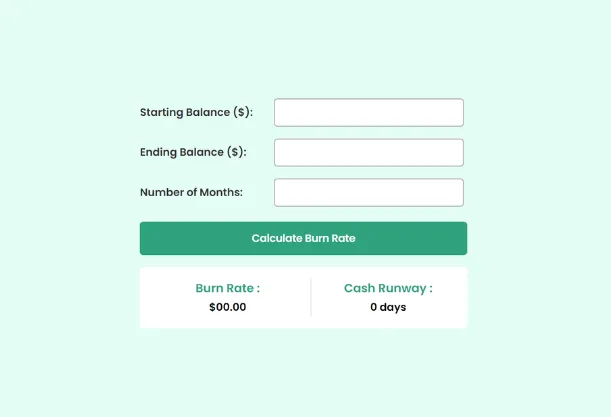

How to Calculate Burn Rate

Step-by-Step Guide

To calculate burn rate accurately, follow these steps:

- Gather financial data

- Identify total monthly expenses

- Determine monthly revenue (for net burn rate)

- Apply the formula (for both gross and net burn rate)

Here's an example walkthrough with numbers:

|

Step |

Action |

Gross Burn Rate |

Net Burn Rate |

|

1 |

Gather financial data |

✓ |

✓ |

|

2 |

Identify monthly expenses |

$65,000 |

$65,000 |

|

3 |

Determine monthly revenue |

N/A |

$40,000 |

|

4 |

Apply formula |

$65,000 |

$65,000 - $40,000 = $25,000 |

Why Burn Rate is Critical for Startups

Cash Runway and Burn Rate

Cash runway is the amount of time a company can continue operating before it runs out of money, assuming the current burn rate remains constant.

Formula: Cash Runway = Cash Available / Net Burn Rate

For example, if a startup has $500,000 in the bank and a net burn rate of $25,000 per month, its cash runway would be:

$500,000 / $25,000 = 20 months

Monitoring and Reducing Burn Rate

To manage burn rate effectively, consider these tips:

- Cut unnecessary costs

- Improve operational efficiency

- Automate processes

- Renegotiate contracts

- Focus on revenue-generating activities

Here's a comparison of high vs. low burn rate startups and their potential outcomes:

|

Aspect |

High Burn Rate Startup |

Low Burn Rate Startup |

|

Cash runway |

Shorter |

Longer |

|

Funding pressure |

Higher |

Lower |

|

Growth potential |

Potentially faster |

Potentially slower |

|

Risk level |

Higher |

Lower |

|

Investor appeal |

Mixed (depends on growth) |

Generally positive |

|

Flexibility |

Lower |

Higher |

Tools for Tracking and Calculating Burn Rate

Manual Calculations vs. Financial Software

Pros and cons of manual vs. software-based burn rate calculations:

Manual Calculations:

- Full control over the process

- No additional costs

- Time-consuming

- Prone to human error

Financial Software:

- Automated calculations

- Real-time updates

- Potential costs

- Learning curve

Popular tools for tracking burn rate include QuickBooks, Xero, and custom spreadsheets. Here's a comparison of manual tracking vs. software tools:

|

Feature |

Manual Tracking |

Software Tools |

|

Accuracy |

Moderate (human error risk) |

High (automated calculations) |

|

Time investment |

High |

Low |

|

Cost |

Low |

Varies (free to premium) |

|

Customization |

High |

Moderate to High |

|

Real-time updates |

No |

Yes |

|

Integration with other financial data |

Limited |

Extensive |

Burn Rate and Investor Interest

Why Investors Care About Burn Rate

Investors assess company health using burn rate in the following ways:

- Evaluating financial efficiency

- Estimating future funding needs

- Assessing management's ability to control costs

- Comparing performance against industry benchmarks

Burn rate benchmarks that investors look for can vary by industry and stage of the company. Here's a general comparison of healthy vs. unhealthy burn rate ranges:

|

Startup Stage |

Healthy Burn Rate |

Unhealthy Burn Rate |

|

Seed |

$10K - $50K/month |

>$100K/month |

|

Series A |

$100K - $200K/month |

>$300K/month |

|

Series B |

$200K - $400K/month |

>$600K/month |

Note: These figures are generalizations and can vary significantly based on industry, location, and specific company circumstances.

Common Mistakes to Avoid When Calculating Burn Rate

Overlooking Variable Expenses

Be sure to include these commonly overlooked variable expenses:

- Utilities

- Travel and entertainment

- Seasonal marketing costs

- One-time purchases or fees

- Contractor or freelancer payments

Ignoring Revenue Fluctuations

Revenue fluctuations can significantly impact net burn rate. Here's a comparison of consistent vs. fluctuating revenue and its impact on burn rate:

As you can see, fluctuating revenue can lead to unpredictable net burn rates, making financial planning more challenging.

Conclusion

Understanding and managing burn rate is crucial for startups and growing businesses. Here are the key takeaways:

- Burn rate measures the rate at which a company spends its cash reserves

- There are two types: gross burn rate and net burn rate

- Calculating burn rate helps determine cash runway and financial health

- Investors use burn rate as a key metric for assessing startups

- Regularly monitoring and managing burn rate is essential for long-term success

- Avoid common mistakes like overlooking variable expenses and ignoring revenue fluctuations

By maintaining a sustainable burn rate, startups can extend their runway, improve their chances of success, and attract potential investors. Remember, the goal is not always to have the lowest possible burn rate, but to find the right balance between growth and financial sustainability.

Rohit Kapoor

Rohit Kapoor