How to Calculate Net Sales: A Comprehensive Guide

In the busy world of business and money, it's really important to know how well your company is doing. One of the most important things to look at is net sales.

But what exactly are net sales, and why are they so important?

Net sales represent the true revenue a company generates from its core business activities after accounting for various deductions. It's the number that tells you how much money your business is really bringing in, stripped of all the extras and adjustments.

Why should you care about net sales?

Well, imagine you're steering a ship. Gross sales might tell you how fast you're going, but net sales tell you how much ground you're actually covering. It's the figure that gives you a clear picture of your business's performance and helps you make informed decisions.

In this comprehensive guide, we'll dive deep into the world of net sales. We'll explore what they are, how to calculate them, and why they matter so much in the business world. So, buckle up and get ready to become a net sales expert!

What is Net Sales?

Net sales, in its simplest form, is the total revenue generated from sales after deducting returns, allowances, and discounts. It's the amount of money a company actually keeps from its sales activities.

Think of it this way: if gross sales are the big, shiny apple you pick from the tree, net sales are what's left after you've cut away any bruises, wormholes, or imperfections. It's the pure, edible part of the apple that you can actually enjoy.

Difference Between Gross Sales and Net Sales

To truly understand net sales, we need to contrast it with its cousin, gross sales. Here's a quick breakdown:

- Gross Sales: This is the total amount of all sales made during a specific period, without any deductions. It's the raw, unadjusted sales figure.

- Net Sales: This is what you get when you take gross sales and subtract returns, allowances, and discounts. It's the realistic picture of your sales performance.

The difference between these two figures can be quite revealing. A company might boast impressive gross sales, but if their net sales are significantly lower, it could indicate issues with product quality, pricing strategy, or customer satisfaction.

Components of Net Sales

To master the art of calculating net sales, you need to understand its components. Let's break them down:

Gross Sales

Gross sales are the starting point for calculating net sales. This figure represents the total amount of all sales before any deductions are made. It's the sum of every dollar that comes into your business through sales activities.

For example, if you sell 100 widgets at $10 each, your gross sales would be $1,000. Simple, right? But as we'll see, this isn't the whole story.

Returns

Product returns are a fact of life in many businesses. Whether it's due to defects, customer dissatisfaction, or simply changing minds, returns can take a bite out of your sales figures.

Returns represent the value of products that customers have purchased and then returned for a refund. These need to be subtracted from your gross sales to get an accurate picture of your actual revenue.

Allowances

Allowances are discounts given after a sale has been made. They're often used to retain customer goodwill when there's a problem with a product or service.

For instance, if a customer receives a damaged product, instead of returning it, they might accept a partial refund or "allowance." This allows the business to avoid a full return while still addressing the customer's concerns.

Discounts

Discounts are reductions in the original selling price of a product or service. There are several types of discounts that can impact your net sales:

- Trade Discounts: These are reductions in price offered to wholesalers and retailers in the distribution chain.

- Cash Discounts: These are incentives for customers to pay their bills quickly. For example, a "2/10 net 30" discount means the customer can deduct 2% if they pay within 10 days, otherwise the full amount is due in 30 days.

- Volume Discounts: These are price reductions offered to customers who buy in large quantities.

- Seasonal Discounts: These are price reductions offered during specific times of the year, often to boost sales during slow periods.

Each of these components plays a crucial role in the calculation of net sales. Understanding them is key to getting an accurate figure and, more importantly, to managing your business effectively.

Formula to Calculate Net Sales

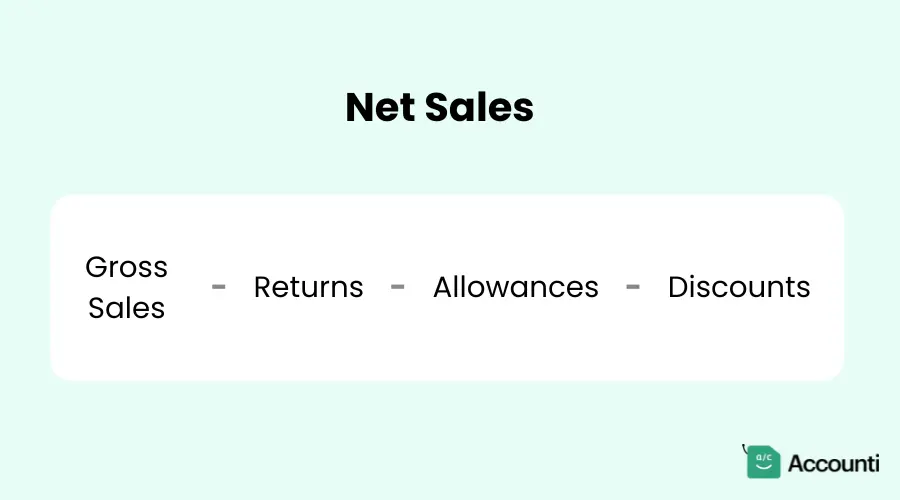

Now that we've dissected the components of net sales, let's put them all together into a formula. The net sales formula is straightforward, but don't let its simplicity fool you - it's a powerful tool for understanding your business's true sales performance.

The Net Sales Formula

Here's the formula for calculating net sales:

Let's break this down step by step:

- Start with Gross Sales: This is your total sales figure before any deductions.

- Subtract Returns: Take away the value of any products that were returned by customers.

- Subtract Allowances: Deduct any allowances given to customers for issues like damaged goods.

- Subtract Discounts: Finally, remove any discounts that were applied to sales.

The result you're left with is your net sales - the true measure of your sales performance.

Example Calculation

To really cement your understanding, let's walk through a hypothetical example of calculating net sales.

Imagine you run a small online bookstore. Here are your figures for the month:

- Gross Sales: $50,000

- Returns: $2,000

- Allowances: $500

- Discounts: $1,500

Let's plug these numbers into our formula:

Net Sales = $50,000 - $2,000 - $500 - $1,500

= $46,000

So, while your bookstore had $50,000 in gross sales, your net sales - the amount you actually get to keep - is $46,000.

This example illustrates why net sales are so important. If you only looked at your gross sales, you might think you performed better than you actually did. The net sales figure gives you a more accurate picture of your business's financial health.

Why Net Sales Matter

Understanding net sales isn't just an accounting exercise - it's a crucial part of running a successful business. Here's why net sales matter so much:

Importance in Financial Statements

Net sales are a key line item on your income statement. They provide a clear picture of your company's ability to generate revenue from its primary business activities. Investors, creditors, and other stakeholders often look at net sales as an indicator of a company's financial health and growth potential.

Influence on Business Decisions

Net sales figures can influence a wide range of business decisions:

- Pricing Strategies: If your net sales are consistently lower than expected due to high discounts, it might be time to reconsider your pricing strategy.

- Product Development: High returns might indicate quality issues, signaling a need for product improvements.

- Customer Service: If allowances are eating into your net sales, it could be time to improve your customer service or quality control processes.

- Marketing and Sales: Net sales can help you evaluate the effectiveness of your marketing campaigns and sales strategies.

- Financial Planning: Accurate net sales figures are essential for budgeting, forecasting, and long-term financial planning.

By focusing on net sales rather than gross sales, you get a more realistic view of your company's performance. This can help you make more informed decisions and set more achievable goals.

Common Mistakes to Avoid When Calculating Net Sales

Even with a straightforward formula, there are several pitfalls to watch out for when calculating net sales. Here are some common mistakes and how to avoid them:

Overlooking Returns, Allowances, and Discounts

It's easy to get excited about high gross sales figures and forget about the deductions. Always ensure you're accounting for all returns, allowances, and discounts. Set up systems to track these accurately, and review them regularly.

Misclassifying Revenue Streams

Not all money coming into your business counts as sales. For example, income from investments or the sale of company assets shouldn't be included in your net sales calculations. Make sure you're only including revenue from your primary business activities.

Ignoring the Timing of Sales Adjustments

Returns, allowances, and discounts don't always happen in the same period as the original sale. It's important to match these adjustments to the correct sales period for accurate reporting. This might mean making adjustments to previous periods' figures when necessary.

Inconsistent Application of the Formula

Ensure that you're applying the net sales formula consistently across all departments and over time. Inconsistencies can lead to inaccurate comparisons and flawed decision-making.

By being aware of these common pitfalls, you can ensure your net sales calculations are accurate and reliable.

Net Sales vs. Gross Sales: A Comparative Analysis

While we've touched on the differences between net sales and gross sales, it's worth diving deeper into this comparison. Understanding the relationship between these two figures can provide valuable insights into your business.

Key Differences

- Inclusions: Gross sales include all sales transactions, while net sales reflect sales after deductions.

- Accuracy: Net sales provide a more accurate picture of actual revenue, while gross sales can be misleading.

- Financial Analysis: Net sales are more useful for financial analysis and forecasting.

- Performance Indicator: Net sales are a better indicator of a company's sales performance and efficiency.

Implications for Financial Analysis and Reporting

- Profit Margins: When calculating profit margins, it's crucial to use net sales rather than gross sales for accuracy.

- Revenue Trends: Comparing net sales over time can reveal trends in customer behavior, product performance, and overall business health.

- Industry Comparisons: When benchmarking against competitors, net sales provide a more level playing field for comparison.

- Investor Relations: Investors and analysts typically focus on net sales figures when evaluating a company's performance.

Understanding both gross and net sales, and the relationship between them, can provide a more comprehensive view of your business's financial health.

How to Improve Net Sales

Now that you understand how to calculate net sales and why they're important, let's look at some strategies to improve them:

Strategies to Reduce Returns, Allowances, and Discounts

- Improve Product Quality: Higher quality products are less likely to be returned or require allowances.

- Enhance Product Descriptions: Accurate and detailed product descriptions can reduce returns by setting correct customer expectations.

- Optimize Pricing Strategy: A well-thought-out pricing strategy can reduce the need for excessive discounts.

- Implement a Smart Discount Strategy: Use discounts strategically to drive sales without unnecessarily eating into your margins.

Enhancing Sales Efficiency and Customer Satisfaction

- Train Your Sales Team: A well-trained sales team can increase sales while reducing the need for discounts or returns.

- Improve Customer Service: Good customer service can reduce returns and the need for allowances.

- Implement a Customer Feedback Loop: Use customer feedback to continually improve your products and services.

- Optimize Your Supply Chain: An efficient supply chain can reduce costs, allowing for more competitive pricing without sacrificing net sales.

- Leverage Data Analytics: Use data to understand sales patterns, customer preferences, and the effectiveness of your strategies.

Remember, the goal isn't just to increase gross sales, but to maximize the sales that actually contribute to your bottom line.

Conclusion

Calculating net sales is more than just a mathematical exercise - it's a crucial skill for anyone involved in business finance. By understanding the components of net sales, mastering the calculation process, and avoiding common pitfalls, you can gain valuable insights into your business's true sales performance.

Net sales provide a realistic picture of your revenue, stripped of the noise of returns, allowances, and discounts. This figure is essential for accurate financial reporting, informed decision-making, and meaningful performance analysis.

Remember, while gross sales might look impressive, it's the net sales that really count. They tell the story of how much money your business is actually bringing in and retaining from its sales activities.

By focusing on improving your net sales - through strategies like enhancing product quality, optimizing pricing, and improving customer satisfaction - you can drive real, sustainable growth in your business.

So, the next time you're looking at your company's sales figures, don't just focus on the top line. Dive deeper, calculate your net sales, and uncover the true story of your business's performance. Your bottom line will thank you for it!

Rohit Kapoor

Rohit Kapoor