How to Calculate Net Working Capital for Better Financial Management

Net Working Capital (NWC) is a crucial financial metric that plays a vital role in assessing a company's financial health and operational efficiency. But what exactly is NWC, and why should you care about it?

In simple terms, Net Working Capital is the difference between a company's current assets and current liabilities. It's a measure of a company's liquidity and short-term financial health.

Think of it as the cash and other assets you can quickly turn into cash to cover your immediate bills and expenses.

Why is calculating NWC so important for companies? Let's break it down:

- Liquidity Assessment: NWC helps you understand if your company can meet its short-term obligations.

- Operational Efficiency: It provides insights into how well you're managing your resources.

- Financial Health Indicator: A positive NWC often signals good financial health.

- Decision-Making Tool: It aids in making informed decisions about investments and growth strategies.

Components of Net Working Capital

To calculate NWC accurately, you need to understand its two main components: current assets and current liabilities.

Current Assets

Current assets are resources that can be converted into cash within one year or one operating cycle, whichever is longer. They're the lifeblood of your daily operations.

Examples of current assets include:

- Cash and cash equivalents

- Accounts receivable

- Inventory

- Marketable securities

- Prepaid expenses

Current Liabilities

On the flip side, current liabilities are obligations that your company expects to settle within one year or one operating cycle.

Common current liabilities are:

- Accounts payable

- Short-term debt

- Current portion of long-term debt

- Accrued expenses

- Unearned revenue

To help you visualize how these components contribute to your NWC, here’s a breakdown chart:

Breakdown of Current Assets and Liabilities

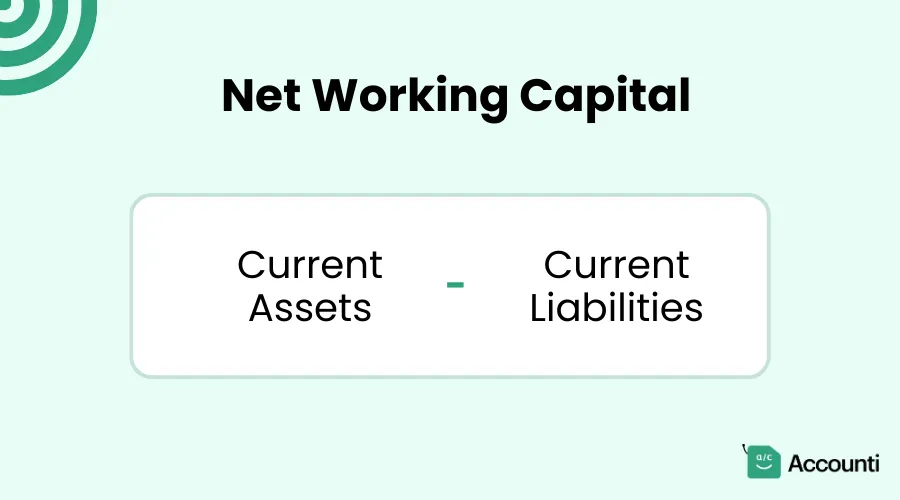

The Formula for Calculating Net Working Capital

Now that we understand the components, let's look at the formula for calculating Net Working Capital:

Net Working Capital = Current Assets - Current Liabilities

It's a straightforward formula, but its simplicity belies its importance. This calculation gives you a quick snapshot of your company's short-term financial position.

For example, if your current assets are $500,000 and your current liabilities are $300,000, your Net Working Capital would be:

$500,000 - $300,000 = $200,000

This positive NWC indicates that you have more short-term assets than short-term debts, which is generally a good sign.

Step-by-Step Guide to Calculating NWC

Let's walk through the process of calculating NWC:

- Gather financial data: Collect your company's balance sheet or financial statements.

- Identify current assets: Sum up all your current assets.

- Identify current liabilities: Total all your current liabilities.

- Apply the formula: Subtract total current liabilities from total current assets.

Here's a sample calculation:

|

Current Assets |

Amount |

Current Liabilities |

Amount |

|

Cash |

$50,000 |

Accounts Payable |

$30,000 |

|

Accounts Receivable |

$75,000 |

Short-term Debt |

$25,000 |

|

Inventory |

$100,000 |

Accrued Expenses |

$15,000 |

|

Prepaid Expenses |

$25,000 |

||

|

Total |

$250,000 |

Total |

$70,000 |

Net Working Capital = $250,000 - $70,000 = $180,000

let’s compare the total current assets and liabilities visually:

Current Assets vs. Current Liabilities

Why Net Working Capital Matters

Understanding your NWC is crucial for several reasons:

- Liquidity Indicator: It shows how easily you can meet short-term obligations.

- Operational Efficiency: A high NWC might indicate you're not using your assets efficiently.

- Growth Potential: Positive NWC can fund growth without additional borrowing.

- Investor and Creditor Confidence: A healthy NWC can attract investors and lenders.

- Financial Flexibility: It provides a buffer for unexpected expenses or opportunities.

Positive vs. Negative Net Working Capital

The sign of your NWC (positive or negative) can tell you a lot about your financial position.

Positive NWC

A positive NWC means your current assets exceed your current liabilities. This is generally good news! It suggests:

- You can easily meet short-term obligations

- You have a financial cushion for unexpected expenses

- You might have room for growth or expansion

However, an excessively high NWC might indicate you're not efficiently using your assets.

Negative NWC

A negative NWC occurs when your current liabilities exceed your current assets. This can be a red flag, indicating:

- Potential liquidity issues

- Difficulty meeting short-term obligations

- Possible need for additional financing

Some businesses, like large retailers, can operate successfully with a negative NWC due to their business model. However, for most companies, a consistently negative NWC is cause for concern.

Improving Net Working Capital

If you find your NWC needs improvement, consider these strategies:

- Optimize inventory management: Reduce excess inventory to free up cash.

- Improve accounts receivable collection: Implement stricter credit policies or offer discounts for early payment.

- Negotiate better terms with suppliers: Try to extend payment terms on your accounts payable.

- Reduce unnecessary expenses: Cut costs where possible to increase your current assets.

- Refinance short-term debt: Convert short-term liabilities into long-term ones to improve your NWC.

Conclusion

Calculating and understanding your Net Working Capital is a fundamental skill for any business owner or financial manager. It provides crucial insights into your company's short-term financial health and operational efficiency.

Remember, NWC is just one piece of the financial puzzle. While a positive NWC is generally good, and a negative one often signals potential issues, context is key. Always consider your industry norms, business model, and overall financial strategy when interpreting your NWC.

By regularly calculating and monitoring your NWC, you can make informed decisions, identify potential issues early, and ensure your business remains on solid financial footing. So, grab your financial statements and start crunching those numbers – your business's financial health depends on it!

Rohit Kapoor

Rohit Kapoor