How to Calculate Operating Income Step-by-Step Guide

Have you ever wondered how businesses measure their operational success? Or how investors gauge a company's profitability from its core business activities?

The answer lies in a crucial financial metric called operating income.

In this comprehensive guide, we'll dive deep into operating income, exploring its significance and, most importantly, how to calculate it accurately.

Brief overview of operating income

Operating income, also known as operating profit or operating earnings, is a key financial metric that measures the profit a company generates from its core business operations. It tells us how much money a business makes from its primary activities before accounting for interest, taxes, and other non-operational factors.

Importance of operating income in financial analysis

Why should you care about operating income? Well, it's like taking the pulse of a business. It provides invaluable insights into a company's operational efficiency and profitability. For investors, analysts, and business owners alike, understanding operating income is crucial for:

- Assessing a company's financial health

- Making informed investment decisions

- Identifying areas for operational improvement

- Comparing performance across different companies or industries

Now that we've set the stage, let's roll up our sleeves and delve into the nitty-gritty of operating income.

What is Operating Income?

Operating income is the profit a company earns from its core business operations after deducting operating expenses from its revenue. It represents the amount of money left over after covering all the costs directly associated with running the business.

Think of it as the money your business makes from its day-to-day activities, minus the costs of those activities. It's like checking your wallet after a busy day at work - how much did you earn, and how much did you spend to earn it?

Difference between operating income and net income

It's easy to confuse operating income with net income, but they're not the same thing. Here's a simple way to remember the difference:

- Operating Income: The profit from core business operations (before interest and taxes)

- Net Income: The total profit after all expenses, including interest, taxes, and non-operating items

In other words, net income is what's left after you've paid for everything, while operating income focuses solely on the money made from your main business activities.

Components of operating income

To understand operating income better, let's break it down into its main components:

- Revenue: The total amount of money earned from selling goods or services

- Cost of Goods Sold (COGS): The direct costs associated with producing goods or services

- Gross Profit: Revenue minus COGS

- Operating Expenses: Indirect costs related to running the business (e.g., rent, salaries, marketing)

Operating income is what remains after subtracting operating expenses from gross profit. It's the result of your business's core activities, stripped down to the essentials.

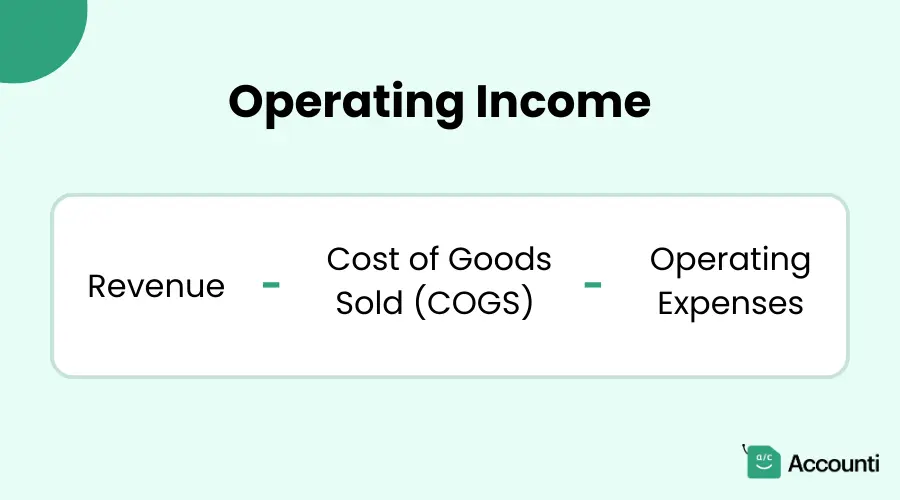

Formula for Calculating Operating Income

Basic formula

Now that we know what operating income is, let's look at how to calculate it. The basic formula for operating income is:

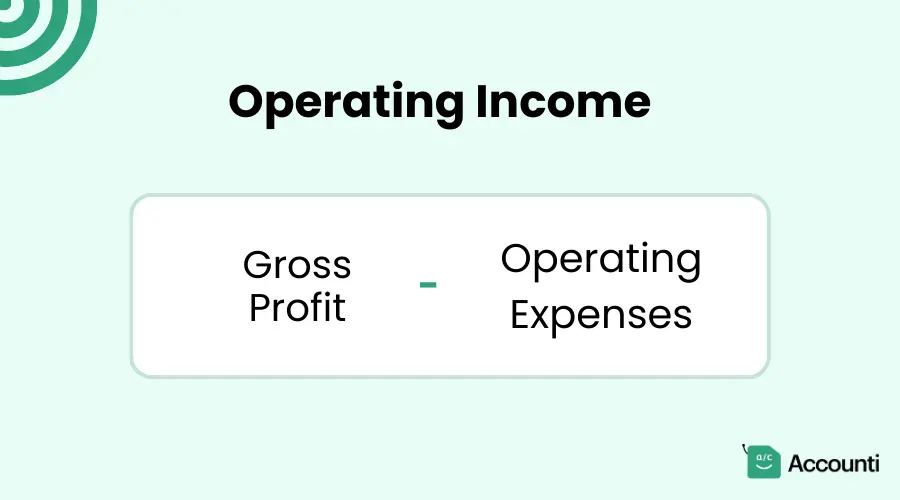

Alternatively, you can also express it as:

Breakdown of each component

Let's break down each component of the formula:

- Revenue:

- Also called sales or turnover

- The total amount of money earned from selling goods or services

- Found at the top of the income statement

- Cost of Goods Sold (COGS):

- Direct costs associated with producing goods or services

- Includes raw materials, direct labor, and manufacturing overhead

- For service businesses, this might be called "Cost of Services"

- Gross Profit:

- Revenue minus COGS

- Represents the profit from selling goods or services before accounting for operating expenses

- Operating Expenses:

- Indirect costs related to running the business

- Includes:

- Selling, General, and Administrative (SG&A) expenses

- Research and Development (R&D) costs

- Depreciation and Amortization

- Rent and Utilities

- Marketing and Advertising expenses

- Employee salaries and benefits (excluding direct labor)

By subtracting these components from revenue, we arrive at the operating income. It's like peeling an onion - we start with the total sales and remove layers of costs until we're left with the core operational profit.

Step-by-Step Guide to Calculating Operating Income

Now that we understand the formula, let's walk through the process of calculating operating income step by step. This guide will help you navigate financial statements and crunch the numbers with confidence.

Step 1: Gather financial statements

Before we start calculating, we need to collect the necessary financial information. You'll need:

- The company's income statement (also called the profit and loss statement)

- Any additional notes or breakdowns of operating expenses

Make sure you have the most recent and accurate financial data available. It's like preparing ingredients before cooking - having everything ready makes the process smoother.

Step 2: Identify revenue

Locate the revenue figure on the income statement. It's usually the first line item and may be labeled as "Sales," "Revenue," or "Total Revenue." This is our starting point - the total money earned from the company's primary business activities.

Step 3: Calculate operating expenses

Next, we need to determine the total operating expenses. This step might require some detective work, as operating expenses can be spread across several line items. Look for:

- Cost of Goods Sold (COGS)

- Selling, General, and Administrative (SG&A) expenses

- Research and Development costs

- Depreciation and Amortization

- Any other expenses related to core business operations

Add these figures together to get your total operating expenses. Remember, we're only interested in expenses directly related to running the business - exclude things like interest expenses or taxes.

Step 4: Subtract operating expenses from revenue

Now comes the final step - applying our formula. Subtract the total operating expenses (including COGS) from the revenue:

Operating Income = Revenue - Total Operating Expenses

And there you have it! The result is the company's operating income. It's the profit generated from core business operations before accounting for interest, taxes, and other non-operational items.

By following these steps, you can calculate operating income for any company, given the right financial information. It's like solving a puzzle - once you know the pieces and how they fit together, it becomes much easier to see the big picture.

Examples of Operating Income Calculation

To really cement our understanding of operating income calculation, let's work through some practical examples. We'll start with a simple scenario and then move on to more complex ones.

Example 1: Simple scenario with basic figures

Let's say we have a small online retailer, "TechGadgets Inc." Here are their basic financial figures for the year:

- Revenue: $500,000

- Cost of Goods Sold: $300,000

- Operating Expenses:

- Salaries: $100,000

- Rent: $30,000

- Marketing: $20,000

To calculate the operating income:

- Total Operating Expenses = COGS + Salaries + Rent + Marketing = $300,000 + $100,000 + $30,000 + $20,000 = $450,000

- Operating Income = Revenue - Total Operating Expenses = $500,000 - $450,000 = $50,000

Therefore, TechGadgets Inc.'s operating income for the year is $50,000.

Example 2: Complex scenario with detailed figures

Now, let's look at a more complex example. "MegaCorp Industries" is a large manufacturing company with diverse operations. Here's their financial data:

- Revenue: $10,000,000

- Cost of Goods Sold: $6,000,000

- Operating Expenses:

- Selling, General & Administrative: $2,000,000

- Research & Development: $500,000

- Depreciation: $300,000

- Amortization: $100,000

- Other Income: $200,000 (from investments)

- Interest Expense: $150,000

- Income Tax Expense: $300,000

To calculate the operating income:

- Total Operating Expenses = COGS + SG&A + R&D + Depreciation + Amortization = $6,000,000 + $2,000,000 + $500,000 + $300,000 + $100,000 = $8,900,000

- Operating Income = Revenue - Total Operating Expenses = $10,000,000 - $8,900,000 = $1,100,000

Note that we didn't include Other Income, Interest Expense, or Income Tax Expense in our calculation, as these are not part of core operations.

Example 3: Service-based business

Let's consider "ConsultCo," a consulting firm:

- Revenue: $2,000,000

- Cost of Services (similar to COGS): $1,200,000

- Operating Expenses:

- Salaries: $400,000

- Office Rent: $100,000

- Travel: $50,000

- Marketing: $30,000

Calculation:

- Total Operating Expenses = Cost of Services + Salaries + Rent + Travel + Marketing = $1,200,000 + $400,000 + $100,000 + $50,000 + $30,000 = $1,780,000

- Operating Income = Revenue - Total Operating Expenses = $2,000,000 - $1,780,000 = $220,000

ConsultCo's operating income is $220,000.

Example 4: Retail chain with multiple stores

Finally, let's look at "FashionForward," a retail chain:

- Revenue: $50,000,000

- Cost of Goods Sold: $30,000,000

- Operating Expenses:

- Store Operating Costs: $10,000,000

- Corporate Overhead: $3,000,000

- Marketing and Advertising: $2,000,000

- Depreciation: $1,000,000

Calculation:

- Total Operating Expenses = COGS + Store Costs + Corporate Overhead + Marketing + Depreciation = $30,000,000 + $10,000,000 + $3,000,000 + $2,000,000 + $1,000,000 = $46,000,000

- Operating Income = Revenue - Total Operating Expenses = $50,000,000 - $46,000,000 = $4,000,000

FashionForward's operating income is $4,000,000.

These examples illustrate how operating income calculation can vary across different types and sizes of businesses, but the core principle remains the same: Revenue minus all expenses related to core operations.

Why Operating Income Matters

Now that we know how to calculate operating income, let's explore why it's such a crucial metric in the business world. Understanding the significance of operating income can help you make better financial decisions, whether you're a business owner, investor, or financial analyst.

Insights for investors and management

Operating income provides valuable insights into a company's operational efficiency and profitability. Here's why it matters:

- Core Business Performance: It shows how well a company is doing in its main line of business, stripped of external factors like investments or tax situations.

- Operational Efficiency: A high operating income relative to revenue suggests efficient operations and good cost management.

- Profitability: It indicates whether the core business model is profitable, regardless of financing decisions or tax environments.

- Trend Analysis: Tracking operating income over time can reveal improvements or declines in a company's operational performance.

- Comparison Tool: It allows for more accurate comparisons between companies, even if they have different tax situations or capital structures.

Role in business decision-making

Operating income plays a crucial role in various business decisions:

- Pricing Strategies: It helps determine if current pricing is sufficient to cover costs and generate desired profits.

- Cost Control: Identifying areas where costs can be reduced to improve operating income.

- Expansion Decisions: Evaluating whether the core business is strong enough to support growth or expansion.

- Resource Allocation: Deciding where to invest resources to maximize operational efficiency.

Comparison with other financial metrics

While operating income is important, it's most useful when considered alongside other financial metrics:

- Gross Profit: Shows profitability before operating expenses. A large gap between gross profit and operating income might indicate high overhead costs.

- Net Income: Provides a complete picture of profitability, including non-operational items. Comparing net income to operating income can reveal the impact of financing decisions and taxes.

- EBITDA: (Earnings Before Interest, Taxes, Depreciation, and Amortization) Similar to operating income but adds back depreciation and amortization. Useful for comparing companies with different depreciation methods.

- Operating Margin: Operating income as a percentage of revenue, showing how much profit is generated from each dollar of sales.

By using operating income in conjunction with these other metrics, you can gain a comprehensive understanding of a company's financial health and performance.

Remember, in the world of finance, no single metric tells the whole story. Operating income is like one vital sign in a medical checkup - important, but most meaningful when considered as part of a complete financial picture.

Common Mistakes in Calculating Operating Income

Even seasoned financial professionals can sometimes stumble when calculating operating income. By being aware of these common pitfalls, you can ensure your calculations are accurate and meaningful. Let's explore some of the most frequent mistakes and how to avoid them.

Misinterpretation of operating expenses

One of the most common errors is misclassifying expenses as operating or non-operating. Here's what to watch out for:

- Including Non-Operating Expenses: Items like interest expenses, losses from asset sales, or restructuring costs are not part of regular operations and should be excluded.

- Excluding Relevant Operating Expenses: Some might forget to include expenses like depreciation or amortization, which are part of operating expenses.

- Overlooking Hidden Operating Costs: Certain expenses, like stock-based compensation, are easy to miss but should be included in operating expenses.

To avoid these mistakes, carefully review each expense item and ask, "Is this a regular cost of running the core business?"

Confusion between gross profit and operating income

It's easy to confuse gross profit with operating income, especially for those new to financial analysis. Here's how to keep them straight:

- Gross Profit = Revenue - Cost of Goods Sold

- Operating Income = Gross Profit - Operating Expenses

Remember, operating income takes into account all operational costs, not just the direct costs of producing goods or services.

Ignoring non-operating expenses

While it's important to exclude non-operating expenses from your operating income calculation, don't ignore them entirely. Non-operating expenses can provide valuable context:

- Interest Expenses: These are excluded from operating income but can significantly impact overall profitability.

- One-Time Charges: Items like restructuring costs or legal settlements are non-operating but can affect a company's financial health.

- Investment Income: Gains or losses from investments are not part of core operations but can influence a company's overall financial picture.

By understanding these non-operating items, you can better interpret what the operating income figure means in the broader context of the company's finances.

To avoid these common mistakes, always:

- Clearly define what constitutes an operating expense for the specific business you're analyzing.

- Double-check your classifications of operating vs. non-operating items.

- Use standardized financial statements and follow generally accepted accounting principles (GAAP) guidelines.

- Consider seeking a second opinion or professional advice if you're unsure about certain items.

Remember, calculating operating income is as much an art as it is a science. It requires careful consideration of each company's unique business model and operational structure. By avoiding these common pitfalls, you'll be well on your way to mastering this crucial financial metric.

Operating Income vs. Other Income Measures

In the world of financial analysis, there are several income measures that might seem similar at first glance. Understanding the differences between these metrics is crucial for accurate financial assessment. Let's compare operating income with other common income measures to clarify their unique roles and applications.

Operating income vs. Gross income

First, let's distinguish between operating income and gross income:

Gross Income (or Gross Profit):

- Definition: Revenue minus Cost of Goods Sold (COGS)

- What it shows: Profitability of producing and selling goods or services before considering operating expenses

- Formula: Gross Income = Revenue - COGS

Operating Income:

- Definition: Profit from core business operations after deducting all operating expenses

- What it shows: Profitability of the core business activities

- Formula: Operating Income = Gross Income - Operating Expenses

Key Difference: Operating income provides a more complete picture of operational profitability by including all costs associated with running the business, not just production costs.

Operating income vs. EBITDA

Now, let's compare operating income with EBITDA:

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization):

- Definition: A measure of a company's overall financial performance

- What it shows: Profitability before accounting for financial and accounting decisions

- Formula: EBITDA = Operating Income + Depreciation + Amortization

Key Differences:

- EBITDA adds back depreciation and amortization, which operating income includes as expenses.

- EBITDA is often used to compare companies with different capital structures or tax rates.

- Operating income provides a more accurate picture of day-to-day operational profitability.

Operating income vs. EBIT

Lastly, let's examine the difference between operating income and EBIT:

EBIT (Earnings Before Interest and Taxes):

- Definition: Profit before accounting for interest expenses and income taxes

- What it shows: Profitability of core business operations, including depreciation and amortization

- Formula: EBIT = Revenue - Operating Expenses (including depreciation and amortization)

Key Differences:

- In many cases, EBIT and operating income are the same.

- Some companies may include non-operating income in EBIT, while operating income strictly focuses on core operations.

- EBIT is sometimes preferred for comparing companies with different tax situations.

Understanding these distinctions is crucial for several reasons:

- Accurate Analysis: Knowing which metric to use ensures you're analyzing the right aspects of a company's performance.

- Comparability: Different metrics allow for fair comparisons between companies of varying sizes, industries, or financial structures.

- Comprehensive Evaluation: Using multiple income measures provides a more complete picture of a company's financial health.

- Investor Communication: Understanding these metrics helps in interpreting financial reports and communicating with stakeholders.

Remember, each of these income measures tells a different part of the financial story. Operating income focuses on core business profitability, gross income highlights production efficiency, EBITDA provides a view of earnings potential before financial obligations, and EBIT offers a middle ground between operating income and net income.

By understanding these nuances, you'll be better equipped to choose the right metric for your specific analysis needs and interpret financial data more accurately.

How to Improve Operating Income

Now that we've explored what operating income is and how to calculate it, let's discuss strategies to improve it. Boosting operating income is a key goal for many businesses, as it directly impacts overall profitability and can make a company more attractive to investors. Here are some effective strategies to enhance your operating income:

Strategies to reduce operating expenses

- Streamline Operations:

- Identify and eliminate inefficiencies in your business processes.

- Implement lean management techniques to reduce waste.

- Consider automating repetitive tasks to save on labor costs.

- Optimize Supply Chain:

- Negotiate better terms with suppliers.

- Consider bulk purchasing to get volume discounts.

- Explore alternative suppliers or materials without compromising quality.

- Energy Efficiency:

- Invest in energy-efficient equipment and lighting.

- Implement energy-saving practices in the workplace.

- Consider renewable energy sources for long-term cost savings.

- Reduce Overhead Costs:

- Evaluate your office space needs - could remote work reduce real estate costs?

- Review and renegotiate contracts for services like insurance, internet, and phone.

- Consider outsourcing non-core functions to reduce fixed costs.

- Efficient Resource Allocation:

- Regularly review and adjust staffing levels to match business needs.

- Invest in employee training to improve productivity.

- Use data analytics to inform decision-making and resource allocation.

Increasing revenue

- Expand Product Lines:

- Introduce new products or services that complement your existing offerings.

- Explore opportunities in adjacent markets.

- Pricing Strategies:

- Analyze your pricing structure - are there opportunities to increase prices without losing customers?

- Consider value-based pricing for premium products or services.

- Implement dynamic pricing to maximize revenue during peak demand periods.

- Enhance Marketing Efforts:

- Invest in targeted marketing campaigns to reach new customers.

- Leverage digital marketing techniques for cost-effective customer acquisition.

- Focus on customer retention strategies to increase lifetime value.

- Expand Market Reach:

- Explore new geographic markets or customer segments.

- Consider e-commerce platforms to reach a wider audience.

- Develop strategic partnerships to tap into new customer bases.

- Upselling and Cross-selling:

- Train your sales team in effective upselling techniques.

- Develop complementary product bundles to encourage higher spend per customer.

- Implement a customer relationship management (CRM) system to identify cross-selling opportunities.

Streamlining operations

- Process Optimization:

- Conduct a thorough review of all business processes.

- Identify bottlenecks and implement solutions to improve efficiency.

- Consider adopting project management methodologies like Six Sigma or Agile.

- Technology Integration:

- Invest in software solutions that can streamline operations (e.g., ERP systems, inventory management software).

- Implement data analytics tools to gain insights and inform decision-making.

- Consider AI and machine learning technologies for predictive analytics and process automation.

- Employee Productivity:

- Implement performance management systems to align employee goals with company objectives.

- Provide regular training and development opportunities.

- Foster a culture of continuous improvement and innovation.

- Inventory Management:

- Implement just-in-time inventory practices to reduce carrying costs.

- Use forecasting tools to optimize stock levels.

- Consider dropshipping or vendor-managed inventory where appropriate.

- Quality Control:

- Implement robust quality control measures to reduce waste and rework.

- Adopt a culture of continuous improvement to gradually enhance product quality and operational efficiency.

Remember, improving operating income is an ongoing process. It requires a balanced approach that focuses on both cost reduction and revenue growth. While cutting costs can provide quick wins, sustainable improvement in operating income often comes from strategic investments in areas that drive efficiency and growth.

Also, it's crucial to monitor the impact of these strategies on your operating income regularly. Use key performance indicators (KPIs) to track progress and be prepared to adjust your approach based on the results.

By implementing these strategies and continuously seeking ways to optimize your operations, you can steadily improve your operating income, leading to increased profitability and a stronger financial position for your business.

Conclusion

As we wrap up our deep dive into operating income, let's recap the key points we've covered and reflect on the importance of this crucial financial metric.

Recap of key points

- Definition: Operating income is the profit a company generates from its core business operations, calculated by subtracting operating expenses from revenue.

- Formula: Operating Income = Revenue - Cost of Goods Sold - Operating Expenses

- Calculation Process:

- Gather financial statements

- Identify revenue

- Calculate operating expenses

- Subtract operating expenses from revenue

- Importance: Operating income provides vital insights into a company's operational efficiency and profitability, crucial for investors, management, and financial analysts.

- Comparisons: We distinguished operating income from other financial metrics like gross income, EBITDA, and EBIT, understanding their unique roles in financial analysis.

- Common Mistakes: We highlighted pitfalls to avoid, such as misclassifying expenses and confusing operating income with other profit measures.

- Improvement Strategies: We explored various ways to enhance operating income, including reducing expenses, increasing revenue, and streamlining operations.

Importance of accurate calculation

Accurate calculation of operating income is paramount for several reasons:

- Decision Making: It provides a clear picture of core business performance, guiding strategic decisions.

- Investor Confidence: Reliable operating income figures build trust with investors and stakeholders.

- Performance Evaluation: It serves as a key metric for assessing management effectiveness and operational efficiency.

- Financial Health: Accurate operating income is crucial for a true understanding of a company's financial well-being.

Final thoughts on utilizing operating income in financial analysis

Operating income is more than just a number on a financial statement - it's a powerful tool for understanding and improving business performance. Here are some final thoughts on its utilization:

- Holistic Approach: While operating income is crucial, it should be considered alongside other financial metrics for a comprehensive analysis.

- Trend Analysis: Look at operating income over time to identify patterns and assess the company's trajectory.

- Industry Comparison: Use operating income to benchmark against industry peers, considering factors like company size and business model.

- Context is Key: Always consider the broader context, including market conditions, company strategy, and industry trends, when interpreting operating income.

- Continuous Improvement: Regularly analyze operating income to identify areas for improvement and track the impact of strategic initiatives.

- Transparency: Maintain clear and consistent methods in calculating and reporting operating income to ensure credibility and comparability.

In conclusion, mastering the calculation and interpretation of operating income is a valuable skill for anyone involved in business finance.

It provides a window into the heart of a company's operations, offering insights that can drive better decision-making, improve performance, and ultimately lead to greater success.

Whether you're an investor evaluating potential opportunities, a manager striving to improve your company's performance, or a financial analyst seeking to understand a business's health, operating income is a metric you'll want to keep in your analytical toolkit.

Remember, in the dynamic world of business, staying informed and adaptable is key. Keep refining your understanding of financial metrics like operating income, and you'll be well-equipped to navigate the complex landscape of modern business finance.

Rohit Kapoor

Rohit Kapoor