How to Calculate Return on Assets: Improve Your Financial Analysis

Return on Assets (ROA) is a crucial financial metric that provides insights into a company's profitability relative to its total assets. For businesses and investors alike, understanding and calculating ROA is essential for assessing operational efficiency and financial health. This article will guide you through the intricacies of ROA, its calculation, and its significance in financial analysis.

Key components we'll explore:

- The definition and importance of ROA

- Step-by-step calculation process

- Real-world examples and interpretations

- Factors affecting ROA and its limitations

- Strategies for improvement

What is Return on Assets (ROA)?

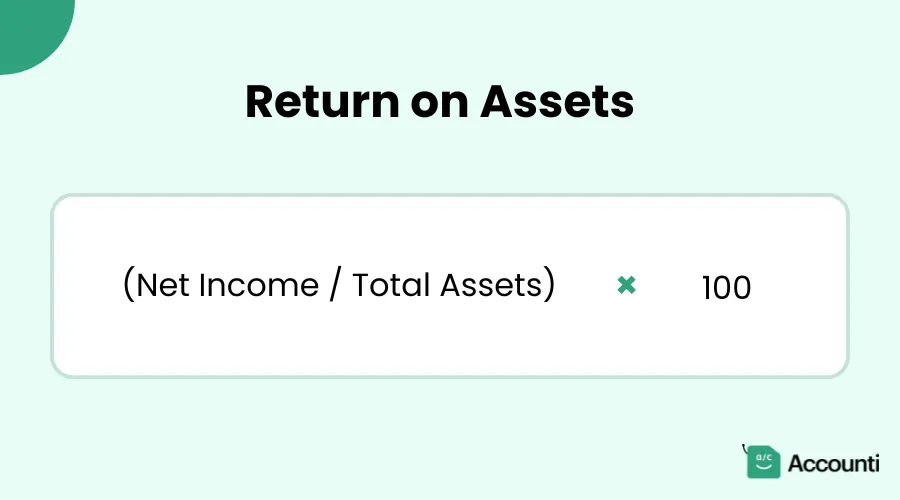

Return on Assets is a profitability ratio that measures how efficiently a company utilizes its assets to generate profit. It's expressed as a percentage and calculated using the following formula:

ROA = (Net Income / Total Assets) × 100

This formula breaks down into two key components:

- Net Income: The company's total earnings after all expenses and taxes

- Total Assets: The sum of all company assets, including cash, inventory, property, and equipment

ROA is vital in financial analysis because it:

- Indicates how well management is using company assets to generate profits

- Allows for comparison between companies of different sizes within the same industry

- Helps in assessing a company's operational efficiency over time

Why is Return on Assets Important?

Understanding ROA is crucial for several reasons:

- Measuring Efficiency: ROA reveals how effectively a company converts its investments in assets into profits.

- Comparing Companies: It provides a standardized metric for comparing companies of different sizes within the same industry.

- Comprehensive View: Unlike some other metrics, ROA considers both the profit margin and asset turnover, offering a more holistic view of company performance.

Let's compare ROA with other financial metrics:

|

Metric |

What It Measures |

Advantages |

Limitations |

|

ROA |

Profitability relative to total assets |

Considers both profitability and asset use |

May be skewed for asset-heavy industries |

|

ROI |

Return on a specific investment |

Useful for evaluating individual projects |

Doesn't consider overall company performance |

|

ROE |

Return on shareholder equity |

Important for stock investors |

Doesn't account for debt levels |

Step-by-Step Guide to Calculating Return on Assets

Follow these steps to calculate ROA:

- Identify Net Income:

- Find this on the income statement

- Ensure it's the after-tax figure

- Identify Total Assets:

- Locate this on the balance sheet

- Use the average of beginning and ending total assets for more accuracy

- Apply the ROA Formula:

ROA = (Net Income / Total Assets) × 100

- Interpret the Results:

- Low ROA (e.g., < 5%): May indicate inefficient asset use

- High ROA (e.g., > 20%): Suggests efficient asset utilization

- Compare with industry averages for context

Example

Let's calculate the ROA for Company X:

Company X's Financials:

- Net Income: $10 million

- Total Assets (beginning of year): $90 million

- Total Assets (end of year): $110 million

Step 1: Calculate average Total Assets

Average Total Assets = ($90 million + $110 million) / 2 = $100 million

Step 2: Apply the ROA formula

ROA = ($10 million / $100 million) × 100 = 10%

Interpretation: Company X has an ROA of 10%, meaning it generates $0.10 of profit for every dollar of assets. Whether this is good depends on the industry average and Company X's historical performance.

Factors Affecting ROA

Several factors can influence a company's ROA:

- Business Model:

- Asset-heavy businesses (e.g., manufacturing) typically have lower ROAs

- Asset-light businesses (e.g., software companies) often have higher ROAs

- Industry Variations:

- Retail: Generally lower ROA due to high inventory and property costs

- Technology: Often higher ROA due to lower physical asset requirements

- Economic Factors:

- Economic downturns can reduce profitability, lowering ROA

- Interest rates affect borrowing costs, impacting net income and ROA

Limitations of ROA

While valuable, ROA has some limitations:

- Capital-Intensive Businesses: May appear less efficient due to high asset values

- Short-Term vs. Long-Term: Doesn't account for long-term investments that haven't yet generated returns

- Intangible Assets: Doesn't fully capture the value of intangibles like brand recognition or intellectual property

- Accounting Methods: Different depreciation methods can affect asset values and ROA calculations

How to Improve Your Return on Assets

To enhance ROA, consider these strategies:

- Increase Profitability:

- Boost sales through marketing and product improvements

- Reduce costs without compromising quality

- Optimize Asset Usage:

- Sell or lease underutilized assets

- Improve inventory management to reduce carrying costs

- Enhance Operational Efficiency:

- Implement lean manufacturing principles

- Utilize technology to streamline processes

Conclusion

Return on Assets is a powerful tool for assessing a company's financial health and operational efficiency. By understanding how to calculate and interpret ROA, businesses can make informed decisions to optimize their asset utilization and improve profitability. Investors can use ROA to compare companies and make smarter investment choices.

Key takeaways:

- ROA measures how efficiently a company uses its assets to generate profit

- It's calculated by dividing net income by total assets and expressing as a percentage

- ROA varies by industry and should be compared to industry benchmarks

- While valuable, ROA has limitations and should be used alongside other financial metrics

- Improving ROA involves increasing profitability, optimizing asset usage, and enhancing operational efficiency

Remember, consistently monitoring and working to improve your ROA can lead to better financial performance and increased shareholder value. By focusing on efficient asset utilization and profitability, businesses can position themselves for long-term success in competitive markets.

Rohit Kapoor

Rohit Kapoor