Difference Between Bookkeeper and Accountant: A Guide for Small Business

When it comes to managing finances, the terms "bookkeeper" and "accountant" can often sound similar—but each role plays a distinct part in keeping a business’s finances on track. Understanding the difference between a bookkeeper and an accountant can help small business owners make better decisions about who to rely on for daily record-keeping versus strategic financial guidance.

Think of a bookkeeper and an accountant like two essential parts of a car engine. The bookkeeper keeps all the pieces moving by handling each transaction and ensuring that records stay neat and up-to-date. Meanwhile, the accountant steps in to interpret that data, providing insights and advice to help the business “engine” run as efficiently as possible. In this guide, we’ll explore what sets a bookkeeper apart from an accountant and help you figure out which one—or both—your business may need.

What is a Bookkeeper?

A bookkeeper is responsible for the daily recording, monitoring, and maintaining of financial transactions. Often referred to as the "record-keeper" of a business, a bookkeeper's role is to ensure that all financial data is accurate, up-to-date, and organized for easy access. Bookkeepers play an essential role in handling the foundational financial information a business relies on to measure success, set goals, and prepare for taxes or audits.

Responsibilities and Duties of a Bookkeeper

Bookkeepers are essential to the day-to-day financial operations of a business. Their primary tasks generally include:

- Recording Transactions: Bookkeepers meticulously document all financial transactions, including sales, expenses, payroll, and payments.

- Managing Invoices and Payments: Ensuring that clients are billed correctly and payments are processed on time.

- Reconciling Accounts: Bookkeepers regularly check and update the business’s accounts to match bank statements, ensuring there are no discrepancies.

- Tracking Receivables and Payables: They monitor outstanding payments owed by customers (receivables) and amounts the business owes to suppliers (payables).

- Generating Reports: Bookkeepers often prepare standard reports like income statements and balance sheets, which provide a snapshot of financial activity.

Common Tools and Software Used by Bookkeepers

Bookkeepers commonly rely on accounting software to maintain accuracy and efficiency. The tools used can vary depending on the industry and the complexity of the business. Here are some popular choices:

- QuickBooks: Widely used by small to medium-sized businesses for bookkeeping.

- Xero: Known for its user-friendly interface, particularly popular among startups.

- Zoho Books: Integrates well with other business software, offering robust bookkeeping solutions.

- Excel / Google Sheets: Though basic, some small businesses still use Excel spreadsheets for simpler bookkeeping tasks.

Bookkeepers ensure that every transaction is accurately recorded and organized, setting a solid foundation that accountants can later build upon.

What is an Accountant?

An accountant takes on a broader role, focusing on interpreting and analyzing the data that bookkeepers collect. Accountants work with financial records to provide insights into a business's performance, optimize financial practices, and ensure compliance with tax laws. Accountants also guide businesses on strategic financial planning, helping them make informed decisions that drive growth.

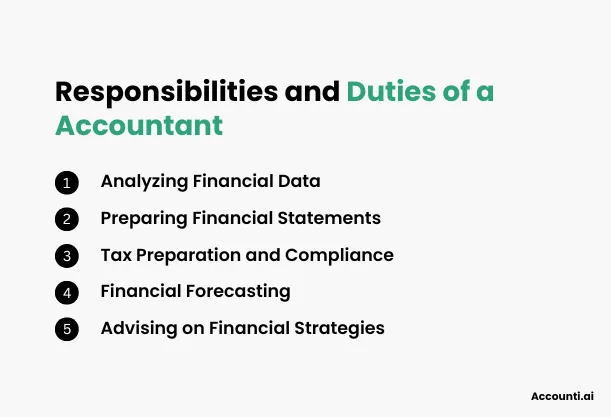

Responsibilities and Duties of an Accountant

Accountants have more advanced duties compared to bookkeepers, as they are responsible for analyzing, reporting, and sometimes even advising on financial strategy. Here’s a look at their primary responsibilities:

- Analyzing Financial Data: Accountants review and analyze financial records, spotting trends and providing actionable insights.

- Preparing Financial Statements: They create formal financial statements, including income statements, balance sheets, and cash flow statements.

- Tax Preparation and Compliance: Accountants ensure that the business complies with tax regulations and helps prepare documents for tax returns.

- Financial Forecasting: Accountants project future revenues, expenses, and cash flows, assisting with budgeting and long-term financial planning.

- Advising on Financial Strategies: Accountants often provide strategic advice to help business owners make informed decisions, such as investment opportunities, cost-cutting measures, or financing options.

Common Tools and Software Used by Accountants

Accountants use a variety of tools, which can vary depending on the complexity of their analysis and the industry they’re working within. Commonly used accounting tools include:

- QuickBooks Accountant: A specialized version of QuickBooks for advanced accounting functions.

- Sage 50 cloud Accounting: Offers a comprehensive suite of accounting tools with a focus on data analysis.

- Microsoft Dynamics: Popular in larger companies for its advanced analytics and ERP capabilities.

- SAP Business One: Known for providing in-depth analytics and insights, popular among larger businesses and enterprises.

Accountants use this information to make sense of the numbers, helping business owners understand what the data reveals about their business’s financial health and guiding them on future actions.

Key Differences Between Bookkeepers and Accountants

While bookkeepers and accountants both deal with financial data, their roles require different skill sets, qualifications, and levels of responsibility. Here’s a closer look at the main distinctions:

Skills and Training Requirements

The skill sets of bookkeepers and accountants vary widely, reflecting the unique demands of each role.

- Bookkeepers: Generally, bookkeepers require strong organizational skills, attention to detail, and proficiency in basic accounting software. While some formal education can be beneficial, many bookkeepers can start with a high school diploma and on-the-job training, depending on the industry. Practical experience is often more valued than advanced degrees for entry-level bookkeeping.

- Accountants: Accountants need a solid understanding of accounting principles, tax laws, and financial analysis. A bachelor's degree in accounting, finance, or a related field is typically required, and many accountants pursue additional certifications such as Certified Public Accountant (CPA) or Certified Management Accountant (CMA). These credentials require rigorous testing and continuing education, underscoring the analytical and advisory nature of an accountant’s role.

Education and Certification Needs

Bookkeepers and accountants also differ in terms of education and certification paths.

- Bookkeepers: Formal certification is not always mandatory for bookkeepers, though obtaining a Certified Bookkeeper (CB) designation from the American Institute of Professional Bookkeepers (AIPB) or a similar organization can enhance credibility. Such certification generally involves passing exams and demonstrating competence in key bookkeeping skills.

- Accountants: Accountants often have a more formal education and may seek certifications to validate their expertise. The CPA certification is one of the most respected credentials in the field, requiring a bachelor’s degree, passing the CPA exam, and meeting additional state requirements. Other certifications, such as CMA or Certified Internal Auditor (CIA), can further specialize an accountant’s skills.

Scope of Work Comparison

The scope of work between bookkeepers and accountants illustrates their differing responsibilities.

- Bookkeepers: Bookkeepers handle daily financial transactions, often working on routine tasks such as data entry, invoice management, and payroll processing. They ensure that the financial records are accurate and up-to-date, providing a clean foundation for accountants to work from.

- Accountants: Accountants interpret and analyze financial information, offering insights that help guide business strategy. Their scope includes preparing tax documents, conducting audits, financial forecasting, and advising on complex financial decisions. Accountants often use the data bookkeepers organize to assess the business’s financial health and recommend ways to improve performance.

Decision-Making Roles in a Business Context

Both roles contribute to decision-making, though their levels of influence vary.

- Bookkeepers: Bookkeepers play a vital role in keeping accurate records but typically have a more limited role in high-level financial decision-making. Their contributions are crucial for day-to-day operations, but they usually don’t advise on strategic matters.

- Accountants: Accountants frequently take part in financial decision-making, advising business owners on tax strategy, financial planning, and investment opportunities. Their expertise in interpreting data makes them invaluable for making informed, strategic decisions that align with business goals.

Bookkeeper vs. Accountant: Which Does Your Business Need?

Choosing between a bookkeeper and an accountant can be challenging, especially for small business owners who may not fully understand the distinctions. However, understanding your business’s financial needs can help clarify which role—or combination of roles—is most beneficial.

When a Bookkeeper is Sufficient

For small or early-stage businesses, a bookkeeper may be all you need. If your financial needs are limited to organizing records, tracking expenses, and managing day-to-day transactions, a bookkeeper can efficiently handle these responsibilities. Bookkeepers are also cost-effective for startups with limited budgets, providing essential services without the added expense of hiring a full-fledged accountant.

Consider hiring a bookkeeper if:

- Your business has straightforward financial needs.

- You need assistance with daily transaction management and basic financial reporting.

- You want a professional to organize financial records for tax season but don’t need advanced tax planning.

When an Accountant is More Appropriate

For more complex financial situations, such as those requiring strategic planning, financial forecasting, or tax optimization, an accountant is a better fit. Accountants bring a depth of expertise in interpreting data and making high-level financial recommendations, which can be especially valuable as a business grows.

Consider hiring an accountant if:

- Your business has complex financial activities, such as handling large assets, investments, or multiple revenue streams.

- You require guidance on tax strategies, audits, or regulatory compliance.

- You need expert advice on financial planning, budgeting, and expansion opportunities.

When Both Roles are Beneficial

Many businesses find that both a bookkeeper and an accountant together provide the most comprehensive financial management. The bookkeeper maintains accurate records, while the accountant uses that data for financial analysis, helping business owners make sound decisions. Employing both can streamline operations and enhance financial oversight.

Businesses may benefit from both roles if:

- They have extensive financial data to manage.

- They need continuous support for both daily transactions and strategic planning.

- They are experiencing growth and need accurate data to support expansion decisions.

Comparison of Bookkeeper vs. Accountant

To simplify, here’s a side-by-side comparison of the roles and responsibilities of a bookkeeper versus an accountant:

|

Aspect |

Bookkeeper |

Accountant |

|

Primary Focus |

Recording daily transactions |

Analyzing and interpreting financial data |

|

Key Responsibilities |

Data entry, invoicing, payroll, reconciliations |

Financial statements, tax preparation, forecasting |

|

Education Requirement |

High school diploma or associate's degree |

Bachelor's degree in accounting or finance |

|

Certifications |

Optional (e.g., Certified Bookkeeper) |

Commonly required (e.g., CPA, CMA) |

|

Decision-Making Role |

Limited |

Strategic planning and advisory |

|

Typical Tools |

QuickBooks, Xero, Zoho Books |

QuickBooks Accountant, Sage 50cloud, SAP |

|

Cost |

Generally lower |

Higher due to specialized skills |

Conclusion

In the journey of managing a business, the financial roles of a bookkeeper and an accountant can often seem blurred. Yet, understanding the unique contributions each brings to the table is invaluable for any business owner. A bookkeeper’s meticulous approach to tracking every dollar spent and earned ensures that the day-to-day financial activities are accurate and orderly. On the other hand, an accountant’s analytical insights and strategic advice can guide a business’s long-term growth and sustainability.

Whether you’re managing a small business or a growing enterprise, knowing when to use a bookkeeper, an accountant, or both can enhance your financial health. A bookkeeper provides the foundational data, and an accountant builds on that data to offer deeper insights and strategies, allowing for sound decision-making. Together, these professionals are like the right and left hands of financial management, each essential in their own way to the overall success and compliance of the business.

In short, if your needs are basic, a bookkeeper might be all you need. But as your business grows, an accountant can be a powerful partner in shaping your financial future. Choosing wisely between these roles—or opting for both—will ultimately depend on your business’s current needs and future ambitions.

FAQs

1. What is the primary difference between a bookkeeper and an accountant?

The primary difference lies in the scope of responsibilities and expertise. Bookkeepers handle the daily recording of transactions, such as expenses, invoices, and payroll, keeping financial records organized and up-to-date. Accountants, on the other hand, analyze these records, prepare tax filings, offer strategic insights, and advise on financial decisions that impact the business’s future.

2. Can a bookkeeper also be an accountant?

While some bookkeepers may possess the skills to perform basic accounting functions, they typically don’t have the formal education or certifications that many accountants hold, like a CPA. However, certain bookkeepers may pursue additional education or certifications, allowing them to expand their role to include accounting functions. For specialized financial analysis or tax advice, however, a qualified accountant is usually recommended.

3. Do I need a bookkeeper or an accountant for a small business?

For small businesses with straightforward financial needs, a bookkeeper may be sufficient to manage daily transactions, invoicing, and payroll. As the business grows and financial needs become more complex, an accountant can provide tax guidance, financial forecasting, and strategic advice that go beyond the role of a bookkeeper. For the most effective financial management, many small businesses eventually benefit from using both professionals.

4. How much does it cost to hire a bookkeeper vs. an accountant?

The cost can vary significantly based on experience, certifications, and location. Bookkeepers generally have lower hourly rates, as their tasks are focused on recording and maintaining data. Accountants tend to charge higher fees due to their advanced expertise and advisory role. On average, bookkeepers may charge between $20 to $50 per hour, while accountants can charge anywhere from $50 to $150 per hour or more, especially if they hold certifications like a CPA.

5. Are there any hybrid roles that combine bookkeeping and accounting?

Yes, some roles combine both bookkeeping and accounting functions, especially in smaller businesses where budget constraints may prevent hiring separate individuals. These hybrid roles may involve recording transactions while also preparing financial reports, handling tax filing, and providing basic financial insights. However, it’s essential to ensure that the person in this role has adequate training and experience to handle both responsibilities effectively.

Rohit Kapoor

Rohit Kapoor