Gross Churn vs Net Churn: Understanding the Key Metrics to Drive Business Growth

When it comes to running a successful business, understanding customer behavior is critical. One key area that often determines success is customer retention. You've probably heard terms like "gross churn" and "net churn" thrown around. But what do they really mean? Why should you care?

In this article, we'll break down these two important metrics, explain their differences, and show you how they can help your business grow. By the end, you'll have a clear grasp of how to track, analyze, and reduce churn rates for long-term success.

What is Gross Churn?

Let's start with gross churn, often referred to simply as "customer churn."

Definition of Gross Churn

Gross churn measures the rate at which your customers stop doing business with you over a specific period. In other words, it tells you how many customers you're losing without considering any growth or recovery factors.

Think of it as the barebones churn number—it shows the losses without the silver linings.

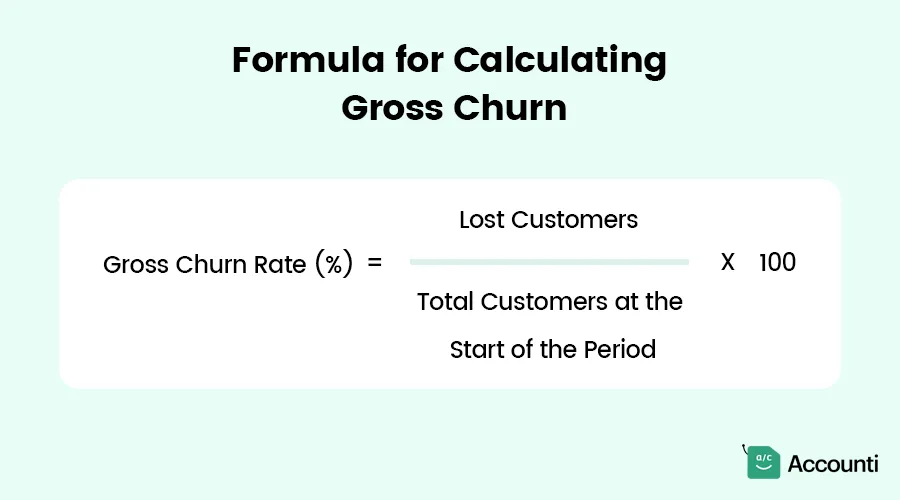

Formula for Calculating Gross Churn

Here's a simple formula to calculate gross churn:

Gross Churn Rate (%) = (Lost Customers÷ Total Customers at the Start of the Period) × 100

For example, if you started with 1,000 customers at the beginning of the month and lost 50, your gross churn rate would be:

(50÷ 1,000) × 100 = 5%

Examples of Gross Churn in Action

Let's say you run a subscription-based software company. If 100 customers cancel their subscriptions out of 2,000 active users during the month, your gross churn rate is 5%. This metric helps you understand how much revenue or how many customers are slipping through the cracks.

Why Gross Churn Matters

Gross churn is a straightforward indicator of customer dissatisfaction. It helps you:

- Identify potential problems with your product or service.

- Determine if your customer retention efforts are working.

- Predict revenue loss due to customer attrition.

What is Net Churn?

Now that we've tackled gross churn, let's explore its more nuanced sibling: net churn.

Net churn measures the net change in your customer base after accounting for expansions, upgrades, and new revenue generated from your existing customers. Essentially, it paints a fuller picture by balancing losses against gains.

Unlike gross churn, net churn can even be negative, which is a great sign for your business.

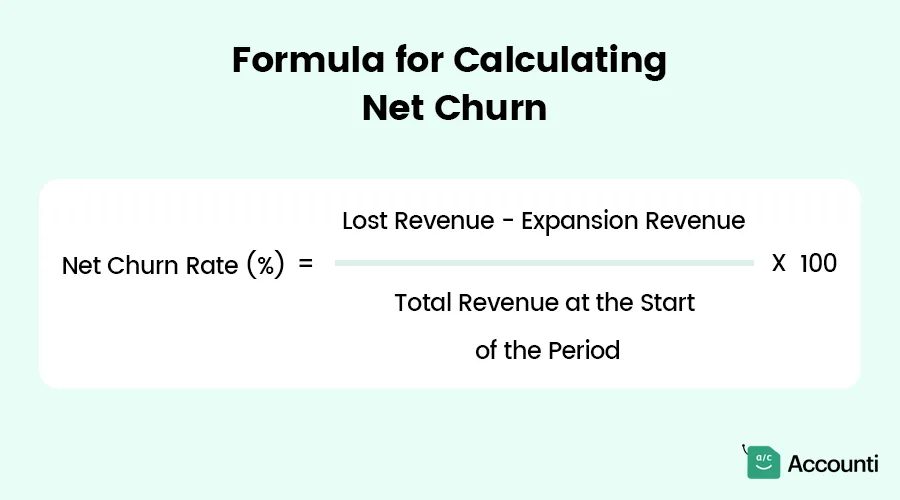

Formula for Calculating Net Churn

Here's how to calculate net churn:

Net Churn Rate (%) = [(Lost Revenue - Expansion Revenue) ÷ Total Revenue at the Start of the Period] × 100

For instance, if you lose $5,000 in revenue but gain $3,000 from upsells and cross-sells, your net churn rate is:

[($5,000 - $3,000)÷ $50,000] × 100 = 4%

Examples of Net Churn in Action

Imagine you own a fitness studio. While you lose 20 members this month, 10 existing members upgrade to premium plans, generating additional revenue. Your net churn reflects both the loss and the gain, giving you a clearer picture of overall customer dynamics.

Why Net Churn Matters

Net churn provides a more comprehensive view of business health because it:

- Highlights the impact of upselling and cross-selling efforts.

- Offers insights into long-term revenue sustainability.

- Helps forecast growth opportunities.

Key Differences Between Gross Churn and Net Churn

Let's break it down even further with a comparison table:

| Aspect | Gross Churn | Net Churn |

| Definition | Total customer or revenue loss | Loss after accounting for revenue recovery |

| Calculation | Excludes growth factors | Includes expansions, upgrades, and recovery |

| Perspective | Focuses only on losses | Balances losses with gains |

| Significance | Highlights immediate retention issues | Shows overall business health |

| Can It Be Negative? | No | Yes |

Examples to Highlight Differences

- Gross Churn Example: You lose 50 customers out of 1,000. That's a gross churn rate of 5%.

- Net Churn Example: You lose 50 customers but upsell 20, recovering part of the lost revenue. Your net churn might only be 2% or even negative, depending on the upsell revenue.

Why Tracking Both Metrics is Crucial

You might wonder, “Why can't I just track one of these metrics?” The answer is simple: Gross churn and net churn provide different insights, and both are essential for a full understanding of your business performance.

Benefits of Tracking Gross Churn

- Early Warning Signal: Gross churn highlights immediate issues with customer satisfaction or product quality.

- Actionable Data: It's a great starting point for identifying areas needing improvement.

Benefits of Tracking Net Churn

- Comprehensive Picture: Net churn balances losses with gains, offering a clearer view of overall business growth.

- Revenue Impact: It shows how effective your upselling and cross-selling efforts are.

How They Work Together

Tracking both metrics ensures you're not missing any critical details. For instance:

- High gross churn but low net churn could indicate strong recovery strategies.

- Low gross churn and negative net churn mean you're excelling in customer retention and expansion.

Strategies to Reduce Churn

Now that you understand gross churn and net churn, let's dive into actionable steps to reduce them.

How to Lower Gross Churn

- Improve Customer Onboarding

- Help new customers understand and use your product effectively.

- Provide tutorials, welcome emails, and personalized support.

- Enhance Customer Support

- Respond quickly to queries and complaints.

- Use chatbots or live chat to provide 24/7 assistance.

- Regularly Collect Feedback

- Use surveys and polls to understand customer needs.

- Act on feedback to improve products and services.

- Proactively Address Pain Points

- Monitor common issues and fix them before they lead to cancellations.

- Offer solutions tailored to customer needs.

- Build a Community

- Foster engagement through forums, events, or social media groups.

- A loyal community reduces the likelihood of churn.

How to Improve Net Churn

- Focus on Upselling and Cross-Selling

- Identify customers who might benefit from premium products or add-ons.

- Offer personalized recommendations based on usage patterns.

- Implement Loyalty Programs

- Reward long-term customers with discounts, perks, or exclusive offers.

- Encourage repeat business through incentives.

- Analyze Expansion Opportunities

- Look for ways to add value to existing services.

- Introduce features that align with customer needs.

- Leverage Predictive Analytics

- Use data to anticipate customer behavior and tailor your offerings.

- Target high-value customers for retention efforts.

- Maintain High-Quality Service

- Consistency is key to keeping customers happy.

- Avoid service disruptions or declines in quality.

Conclusion

Understanding the difference between gross churn and net churn is essential for any business aiming to thrive in today's competitive landscape. While gross churn gives you a raw picture of customer losses, net churn adds context by accounting for revenue recovery and growth.

By tracking both metrics, you can identify areas for improvement, develop targeted strategies, and ultimately create a sustainable growth plan. Remember, reducing churn isn't just about keeping customers—it's about continuously adding value and meeting their needs.

So, whether you're just starting or looking to refine your retention strategy, make gross churn and net churn your go-to metrics for insight and growth.

FAQs

What does a 5% churn rate mean?

A 5% churn rate indicates that a company has lost 5% of its customers over a specific period. For instance, if a business starts the year with 1,000 customers and loses 50 during that year, the churn rate is 5%. This suggests that while the majority of customers are retained, there may be underlying issues causing some to leave.

What is the KPI for churn rate?

Churn rate is a critical Key Performance Indicator (KPI) that measures the percentage of customers who discontinue their relationship with a company within a given timeframe. Monitoring this KPI helps businesses understand customer retention levels and identify areas needing improvement to reduce customer attrition.

What is the difference between gross retention and churn?

Gross retention and churn are related but distinct metrics. Gross retention measures the percentage of existing customers or revenue retained over a period, excluding any new customers or revenue gained. In contrast, churn rate calculates the percentage of customers or revenue lost during the same period. While gross retention focuses on the customers or revenue kept, churn highlights the losses.

What is a bad churn rate?

A "bad" churn rate varies by industry, but generally, a higher churn rate is detrimental to business health. For example, a churn rate exceeding 10% is often considered problematic, signaling potential issues with customer satisfaction or product quality. However, acceptable churn rates differ across sectors; for instance, SaaS companies often aim for a churn rate below 3%.

What is the difference between churn rate and turnover rate?

Churn rate and turnover rate both measure the loss of individuals from a company but in different contexts. Churn rate typically refers to the percentage of customers who stop using a company's products or services over a specific period. Turnover rate, on the other hand, pertains to the percentage of employees who leave an organization within a certain timeframe. While both metrics assess attrition, churn rate focuses on customers, whereas turnover rate focuses on employees.

Rohit Kapoor

Rohit Kapoor