How Long Do You Need to Keep Tax Returns? Know the Timeframes

Keeping tax returns is like holding onto a financial time machine—you never know when you might need to revisit the past. But how long should you keep these documents cluttering up your drawers or taking up space on your hard drive? Let's unravel this financial mystery together.

We all dread that moment when we open a drawer overflowing with old documents. Among them, tax returns often take up a significant chunk of space. It's tempting to toss them out, especially when you're on a decluttering spree. But before you feed them to the shredder, it's crucial to know the recommended retention periods. So, how long do you really need to keep your tax returns? Let's dive in and find out.

General IRS Guidelines

The Internal Revenue Service (IRS) sets the baseline for how long taxpayers should keep their returns and supporting documents.

The 3-Year Rule

- Standard Retention Period: The IRS generally recommends keeping your tax returns for three years from the date you filed the original return.

- Why Three Years?: This period corresponds to the statute of limitations for the IRS to audit your return or for you to file an amended return.

Example: If you filed your 2020 tax return on April 15, 2021, you should keep that return and all supporting documents until at least April 15, 2024.

Situations Requiring Longer Retention

While the three-year rule applies to most taxpayers, certain situations require you to hold onto your documents for longer.

Underreported Income

- 6-Year Rule: If you underreport your income by more than 25%, the IRS extends the audit window to six years.

- Reasoning: This allows the IRS more time to investigate substantial discrepancies.

Example: If you failed to report $15,000 of income on a $50,000 income return, you should keep your records for six years.

Fraudulent Activity and Unfiled Returns

- No Statute of Limitations: If you file a fraudulent return or don't file at all, the IRS can audit you at any time.

- Recommendation: Keep records indefinitely if you haven't filed or if there's any question about the accuracy of your return.

Worthless Securities and Bad Debt

- 7-Year Rule: For claims related to worthless securities or bad debt deductions, retain documents for seven years.

- Explanation: These complex situations may require extended verification periods.

State Requirements

Your state tax agency might have different rules from the IRS.

Understanding State Statutes

- Varied Time Frames: State statutes of limitations can range from 3 to 6 years or more.

- State-Specific Guidelines: Always check your state's Department of Revenue or equivalent agency for precise information.

Table: State Retention Period Examples

|

State |

Retention Period |

|

California |

4 years |

|

New York |

3 years |

|

Texas |

No state income tax |

|

Massachusetts |

6 years |

Note: Always verify with your state's tax agency.

Benefits of Keeping Tax Returns Longer

Beyond legal requirements, there are practical reasons to retain your tax documents longer.

Financial Planning and Analysis

- Trend Tracking: Analyze your financial growth, income patterns, and deductions over the years.

- Future Reference: Use past returns to inform future tax strategies and investment decisions.

Loan and Mortgage Applications

- Proof of Income: Lenders often require up to two years of tax returns.

- Credit Applications: Tax returns can support applications for credit cards or other financial products.

Insurance Claims and Legal Matters

- Documentation: In the event of loss due to theft, disaster, or other circumstances, tax records can substantiate claims.

- Legal Defense: Records can serve as evidence in legal disputes or audits.

Digital vs. Physical Storage

In the digital age, storing documents has become more flexible.

Advantages of Digital Storage

- Space Efficiency: Save physical space by scanning documents.

- Accessibility: Access your records anytime and anywhere.

- Security: Protect files with encryption and password protection.

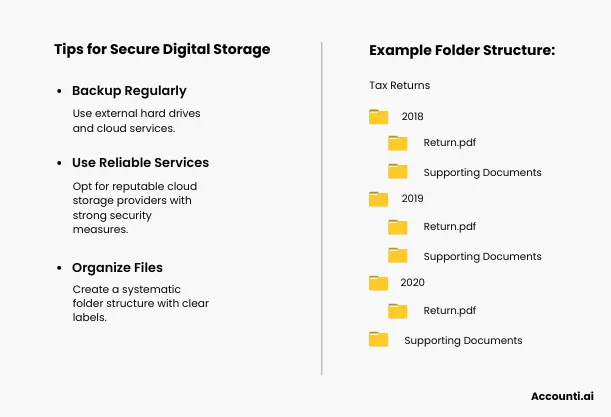

Tips for Secure Digital Storage

Physical Storage Solutions

- Fireproof Safes: Invest in a fireproof and waterproof safe for important documents.

- Secure Locations: Keep documents in a secure, dry place to prevent damage.

- Organizational Tools: Use folders and labels to keep everything orderly.

Proper Disposal of Old Tax Returns

When it's time to let go, do it responsibly.

Shredding Documents

- Prevent Identity Theft: Shred documents to protect personal information.

- Cross-Cut Shredders: Use a cross-cut shredder for maximum security.

Environmental Considerations

- Recycling: Recycle shredded paper according to local regulations.

- Community Shredding Events: Participate in local events that offer secure document destruction and recycling.

Quick Reference Table

|

Situation |

Retention Period |

|

Standard Tax Return |

3 years |

|

Underreported Income (>25%) |

6 years |

|

Fraudulent Return or No Return Filed |

Indefinitely |

|

Worthless Securities/Bad Debt |

7 years |

|

State Taxes |

Varies by State |

Conclusion

Keeping your tax returns isn't just about obeying the law—it's about safeguarding your financial well-being. While the general rule of thumb is to keep tax returns for three years, various factors may necessitate a longer retention period. By understanding the guidelines and considering your personal circumstances, you can make informed decisions about how long to keep these important documents. Remember, when in doubt, it's better to hold onto records a little longer than to find yourself needing a document you discarded.

FAQs

How long should businesses keep tax records?

Businesses should keep tax records for at least seven years. This accounts for various IRS statutes and potential state requirements. Additionally, certain records like employment tax records should be kept for at least four years after the date the tax becomes due or is paid.

Are electronic copies of tax returns acceptable to the IRS?

Yes, the IRS accepts electronic records. Digital copies are considered valid as long as they are accurate and contain all the information from the original documents. Ensure that electronic records are legible and stored securely.

What supporting documents should I keep with my tax returns?

Keep all documents that support the income, deductions, and credits you report. This includes W-2s, 1099s, receipts, canceled checks, and bank statements. These should be retained for the same period as your tax returns.

Do I need to keep old tax returns after I retire?

Yes, you should keep tax returns for the recommended periods even after retirement. This is important for verifying income for Social Security benefits, pension plans, and any future tax inquiries.

How can I obtain copies of past tax returns if I've lost them?

You can request a tax return transcript for free from the IRS using the Get Transcript tool on their website. For exact copies of your tax returns, file Form 4506 and pay the applicable fee.

Rohit Kapoor

Rohit Kapoor