How to Transfer Shares to Demat Form: A Guide for Foreign Investors

Managing investments can feel overwhelming, especially if you're a foreign investor with shares spread across different countries. The old-fashioned paper share certificates are quickly becoming a thing of the past, with more investors opting to transfer their holdings into a dematerialized (demat) account. But how exactly do you, as a foreign investor, transfer shares into a demat form?

This guide will walk you through the entire process of transferring shares to demat form, highlighting the benefits and the steps to make the transition smooth and efficient. Let’s get started!

What is a Demat Account?

Before we get into the mechanics of transferring shares, it's essential to understand what a demat account is and why it's important.

Definition and Explanation

A Demat Account, short for dematerialized account, is an electronic account that holds your shares and securities in a digital format rather than in physical certificates. It functions similarly to a bank account, where instead of holding money, your demat account holds your financial securities like stocks, bonds, and mutual funds.

Traditionally, shares were issued in the form of physical certificates, which posed risks such as loss, damage, forgery, or theft. Dematerialization (converting physical shares into electronic form) eliminates these risks by storing your investments digitally, making transactions faster and more secure.

Key Benefits of Having a Demat Account

For foreign investors, the demat form comes with multiple advantages:

- Security: No fear of loss, theft, or damage to physical certificates.

- Ease of Transactions: Buying and selling shares become instantaneous.

- Cost-Effective: No more stamp duties or handling fees for physical certificates.

- Convenience: Track and manage your investments across different markets in one place.

- Compliance: Many countries now require that shares be held in demat form for trading purposes.

Why Foreign Investors Should Transfer Shares to Demat Form

If you're a foreign investor holding physical shares, you might be wondering if transferring them to demat form is worth the hassle. Spoiler alert—it absolutely is! Here’s why:

Enhanced Security

The thought of your investment in the form of paper, vulnerable to loss, damage, or fraud, can be unnerving. By converting physical shares to demat form, you ensure that your shares are safely stored in electronic format. Digital records are much easier to manage and protect against risks like theft, loss in transit, or damage due to natural disasters.

Ease of Transaction and Monitoring

As an investor, especially a foreign one, it can be challenging to monitor your holdings across various markets. Demat accounts allow you to access and track your portfolio anytime, anywhere. Buying and selling shares through a demat account is also much faster. When you want to liquidate or transfer shares, it takes only a few clicks instead of dealing with the tedious paperwork of physical certificates.

Compliance with Global Standards

Many countries have made it mandatory for investors to hold their shares in demat form to comply with local financial regulations. If you're investing internationally, holding shares in demat form will help ensure that you remain compliant with these rules, saving you from unnecessary legal complications.

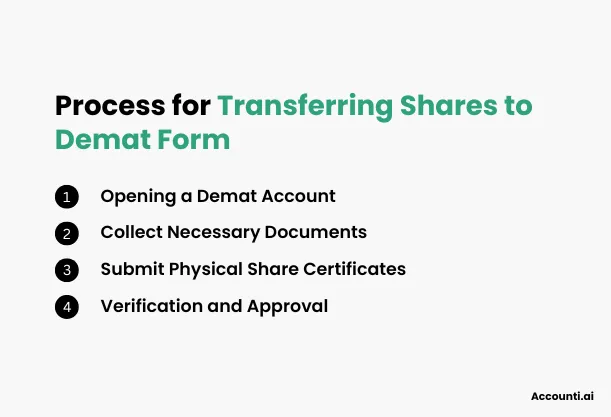

Step-by-Step Process to Transfer Shares to Demat Form

Ready to transfer your shares? Follow this step-by-step guide to make the process smooth and stress-free.

Step 1: Opening a Demat Account

To begin the process, you need to open a demat account with a Depository Participant (DP). A DP is a financial institution, like a bank or brokerage, authorized to offer demat services.

Requirements for Foreign Investors

Foreign investors need to ensure they meet the eligibility criteria of the country they wish to invest in. For example, in India, foreign investors must register with SEBI (Securities and Exchange Board of India) under the Foreign Portfolio Investor (FPI) category before opening a demat account.

Process of Account Opening

Opening a demat account is a straightforward process:

- Choose a DP: Research and choose a reputable DP that offers services to foreign investors. For foreign investors looking for a reliable demat service provider in India, platforms like accounti.ai's India demat service can help streamline the process.

- Complete the Application: You’ll be required to fill out an account opening form. Many DPs now allow online applications for foreign investors.

- Provide Identification: You’ll need to submit identification documents, which we’ll discuss in the next section.

- In-Person Verification: Some countries may require you to undergo an in-person verification process.

- Activate Your Account: Once your documentation is verified, your demat account will be activated, and you’ll receive details on how to access it.

Step 2: Collect Necessary Documents

Foreign investors must provide specific documentation to verify their identity and address. The documentation requirements may vary slightly depending on the country and DP, but typically, you'll need:

- Passport: A valid passport to verify your identity.

- Proof of Address: Utility bills, bank statements, or any other government-issued documents that show your current address.

- Tax Identification Number (TIN): Some countries might require proof of your tax ID for regulatory purposes.

- Proof of Bank Account: In some cases, you'll need to link a local bank account to your demat account.

Be sure to check the requirements of the country you’re investing in, as different countries may have varying rules for foreign investors.

Step 3: Submit Physical Share Certificates

Once your demat account is up and running, the next step is to convert your physical shares into electronic format.

Handling Physical Share Certificates

You need to submit the original physical share certificates you wish to convert. Before submission, double-check that your name, company details, and share quantity on the certificates match the records in your account. Any discrepancies could delay the process.

Procedure for Submission

- Fill out the Dematerialization Request Form (DRF): The DP will provide you with a DRF, where you’ll need to mention details of the shares you’re transferring.

- Submit the DRF and Certificates to Your DP: Hand over the physical share certificates along with the DRF to your DP.

- Acknowledgment Receipt: Once submitted, you will receive an acknowledgment receipt, which acts as proof of submission.

Step 4: Verification and Approval

After submitting the certificates and DRF, the verification process begins. Your DP will send the certificates to the respective company or its registrar for confirmation. Once the verification is completed, the company will notify the DP, and your shares will be credited to your demat account.

Timeframe for Approval

The entire process of dematerialization typically takes between 2 to 3 weeks. However, this may vary depending on the country’s rules and the number of shares being dematerialized.

Costs and Fees Associated with Dematerialization

Like any financial transaction, there are costs involved in opening and maintaining a demat account. Here’s a breakdown of the typical charges foreign investors might incur:

Charges for Opening and Maintaining a Demat Account

Most DPs charge an account opening fee, but this varies depending on the institution. Some may offer promotions waiving these fees, especially if you're an international investor with a sizable portfolio.

Additionally, there may be an Annual Maintenance Fee (AMC), which is typically a small percentage of your portfolio’s value or a fixed fee charged yearly to keep your account active.

Transaction Fees

While most dematerialization transactions are relatively low-cost, some DPs may charge a transaction fee for converting physical shares to demat form. These fees could be flat-rate or based on the number of shares being converted.

Challenges Foreign Investors May Face

Transferring shares to demat form as a foreign investor is not without its challenges. Here are some common issues and how to overcome them:

Hurdle 1: Documentation Delays

Foreign investors often face delays in processing documents, especially when dealing with cross-border transactions. To minimize this, ensure all your documents are in order before submitting them. Double-check that your identification and address proofs meet the local requirements.

Hurdle 2: Currency Exchange Rates

While the dematerialization process itself might be straightforward, managing currency exchange rates could become a challenge if you're converting dividends or selling shares. To avoid currency losses, work with a DP that offers competitive exchange rates or helps mitigate currency fluctuation risks.

Hurdle 3: Regulatory Restrictions

Some countries have regulatory restrictions for foreign investors when it comes to holding shares in local companies. For instance, certain countries have caps on how much foreign ownership is allowed in specific sectors. It’s essential to be aware of these regulations and ensure that you're compliant to avoid legal issues down the road.

Conclusion

Dematerializing your shares is not just a smart move, it’s often a necessary one—especially for foreign investors. The benefits far outweigh the hurdles: from enhanced security and seamless transactions to compliance with global financial standards. While the process may seem complex, it becomes manageable when broken down into simple steps.

By following this guide and transferring your shares to a demat form, you'll make your investments more secure, accessible, and compliant with international norms. For any foreign investor, this is a crucial step toward modernizing your portfolio and simplifying your investment management.

FAQs

1. What is the average time to complete the dematerialization process?

The dematerialization process typically takes between 2 to 3 weeks. This time may vary depending on the DP and the country in which the shares are being dematerialized.

2. Can a foreign investor open multiple demat accounts?

Yes, foreign investors can open multiple demat accounts, provided they meet the regulatory requirements in each country. However, managing multiple accounts can become complex, so it’s best to consolidate your holdings whenever possible.

3. What happens if the shares are lost before dematerialization?

If your physical share certificates are lost before dematerialization, you must contact the issuing company or its registrar. They will guide you through the process of obtaining duplicate certificates, which you can then dematerialize.

4. Are there tax implications for foreign investors when transferring shares?

In most cases, transferring shares to demat form itself does not have direct tax implications. However, if you sell the shares afterward, you may be subject to capital gains tax in the country where you hold the shares.

5. Is it mandatory for foreign investors to have a demat account in every country they invest in?

No, it’s not mandatory to have a demat account in every country. However, for ease of managing investments and complying with local regulations, it's often recommended to open a demat account in the country where you hold significant shares.

Rohit Kapoor

Rohit Kapoor