How to Find Income from Operations: Navigating Corporate Finance

Have you ever wondered how companies measure their operational efficiency? Well, that's where income from operations comes into play.

It's a crucial metric that can tell you a lot about a company's financial health and performance.

In this article, we'll dive deep into the world of income from operations, exploring what it is, how to calculate it, and why it's so important for businesses and investors alike.

We'll cover everything from the basic definition to real-world examples, so by the end of this guide, you'll be an expert in finding and interpreting income from operations. So, let's roll up our sleeves and get started!

What is Income from Operations?

Income from operations, also known as operating income, is a measure of a company's profit from its core business activities before accounting for interest and taxes.

It's like taking a snapshot of how well a company is doing in its day-to-day operations, without the distractions of financial maneuvering or tax strategies.

Why should you care about income from operations?

Well, it's a bit like checking the engine of a car before buying it. This metric gives you a clear picture of how efficiently a company is running its core business.

It strips away the noise of non-operating activities and focuses on what really matters - how well the company is doing what it's supposed to do.

For investors, analysts, and managers, income from operations is a goldmine of information. It helps in:

- Assessing operational efficiency

- Comparing performance across different companies in the same industry

- Making informed decisions about investments or strategic changes

Calculating Income from Operations

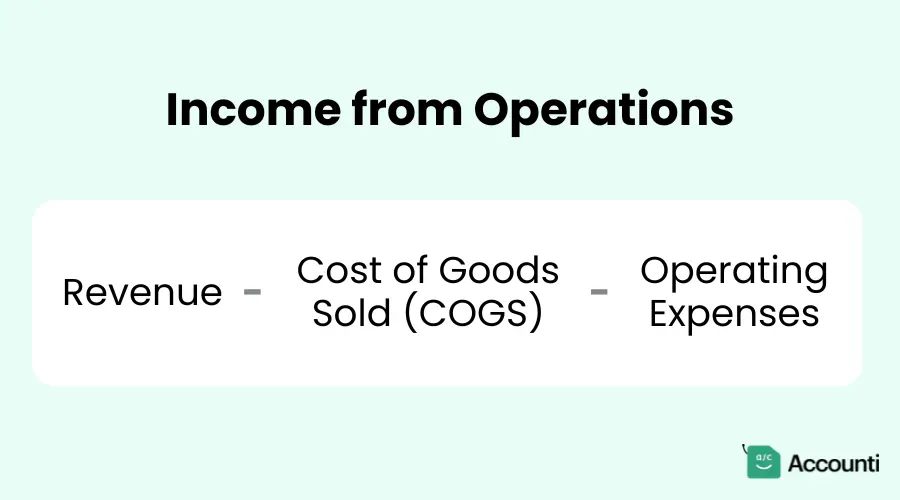

The formula for calculating income from operations is refreshingly straightforward:

It's that simple! But let's break it down further to make sure we're all on the same page.

Step-by-Step Calculation

Let's walk through an example to see how this works in practice. Imagine we're looking at a fictional company, "TechGadgets Inc."

- Revenue: $1,000,000 (This is all the money TechGadgets earned from selling its products)

- Cost of Goods Sold (COGS): $600,000 (This is what it cost TechGadgets to produce the products it sold)

- Operating Expenses: $250,000 (This includes things like rent, salaries, marketing costs, etc.)

Now, let's plug these numbers into our formula:

Income from Operations = $1,000,000 - $600,000 - $250,000 = $150,000

So, TechGadgets Inc. has an income from operations of $150,000. Not too shabby!

Common Pitfalls

While the calculation seems straightforward, there are a few traps you need to watch out for:

- Including non-operating income: Don't mix in things like investment income or gains from asset sales. These aren't part of the core business operations.

- Forgetting about depreciation and amortization: These are operating expenses and should be included in your calculation.

- Overlooking one-time expenses: Be careful with unusual or one-time costs. They might skew your analysis if not properly accounted for.

Why Income from Operations is a Key Metric

Comparison with Net Income

You might be wondering, "Why bother with income from operations when we have net income?" Good question! While net income gives you the bottom line, income from operations tells you a different story.

Net income includes everything - operating income, interest, taxes, and other non-operating items. Income from operations, on the other hand, focuses solely on the core business activities. It's like comparing a photo of an entire landscape (net income) to a close-up shot of the main subject (income from operations).

Insight into Business Efficiency

Income from operations is like a report card for a company's operational efficiency. It tells you how well a company is managing its core business costs relative to its revenue. A high income from operations suggests that the company is running a tight ship, efficiently turning its revenue into profit.

How to Interpret Income from Operations

Positive vs. Negative Income

A positive income from operations is generally a good sign. It means the company is making money from its core business activities. However, don't pop the champagne just yet! The size of the income relative to revenue is also important.

A negative income from operations is a red flag. It suggests the company isn't generating enough revenue to cover its operating costs. This could be a sign of inefficiency, high costs, or pricing issues.

Trends Over Time

One number doesn't tell the whole story. Look at income from operations over several quarters or years. Is it growing? Shrinking? Fluctuating wildly? A consistent upward trend is generally a positive sign, while a downward trend might indicate problems.

Comparing Across Companies

Income from operations is a great tool for comparing companies within the same industry. But remember, context is key! A smaller company might have a lower income from operations in absolute terms, but could be more efficient relative to its size.

Using Income from Operations in Decision Making

Investment Decisions

For investors, income from operations is like a crystal ball. It helps predict a company's future performance and potential for growth. A consistently high and growing income from operations could indicate a solid investment opportunity.

Management Strategies

For company managers, this metric is a powerful tool for identifying areas of improvement. Low income from operations might prompt a closer look at costs or pricing strategies. High income could suggest it's time to invest in growth or return value to shareholders.

Financial Health Indicators

Income from operations is just one piece of the financial health puzzle. It works best when used alongside other metrics like profit margins, return on assets, and cash flow. Together, these paint a comprehensive picture of a company's financial wellbeing.

Real-World Examples

Case Study 1: Apple Inc.

Apple is known for its strong financial performance. In their fiscal year 2020, Apple reported:

- Revenue: $274.52 billion

- Cost of Sales: $169.56 billion

- Operating Expenses: $38.67 billion

Using our formula:

Income from Operations = $274.52B - $169.56B - $38.67B = $66.29 billion

This impressive figure shows how efficiently Apple turns its massive revenue into operational profit.

Case Study 2: Tesla Inc.

Tesla, while successful, has had a more volatile history with income from operations. In 2019:

- Revenue: $24.58 billion

- Cost of Revenue: $20.51 billion

- Operating Expenses: $4.14 billion

Income from Operations = $24.58B - $20.51B - $4.14B = -$0.07 billion

Tesla's negative income from operations that year reflected its heavy investments in growth and the challenges of scaling up production.

Lessons Learned

These examples show that:

- A high income from operations (like Apple's) can indicate a well-run, profitable business.

- A negative income from operations (like Tesla's in 2019) isn't always a death sentence, especially for growing companies investing heavily in the future.

- Context matters - industry, company stage, and growth strategies all play a role in interpreting this metric.

Conclusion

Finding and understanding income from operations is a crucial skill for anyone interested in business finance. It's a powerful tool that cuts through the noise and gives you a clear picture of a company's operational efficiency.

Remember, while the calculation is simple (Revenue - COGS - Operating Expenses), the interpretation requires context and careful analysis.

Use it alongside other financial metrics, consider trends over time, and always keep the bigger picture in mind.

Whether you're an investor sizing up a potential opportunity, a manager looking to improve your company's performance, or just a curious individual wanting to understand business better, mastering income from operations will serve you well. So go forth and crunch those numbers - you've got this!

Rohit Kapoor

Rohit Kapoor