Financial Accounting vs. Managerial Accounting: What Works Best for You?

When it comes to accounting, businesses rely on two major types: managerial accounting and financial accounting. Though both deal with financial data, their purposes and approaches are quite different. If you’re running a business or managing finances, understanding these two types of accounting is crucial for making informed decisions. So, which one works better for you? Let’s dive into the details to help you decide.

Accounting serves as the backbone of any business, allowing organizations to track, report, and analyze financial information. But not all accounting is the same. Financial accounting and managerial accounting are two sides of the same coin, each playing a unique role in business operations.

In simple terms, financial accounting focuses on creating standardized reports for external stakeholders, while managerial accounting is designed for internal decision-making. Yet, the contrast between these two goes far deeper than that. To truly grasp how these accounting methods work, it’s essential to break down their definitions, uses, and what sets them apart.

In this article, we’ll compare managerial accounting and financial accounting, explore their functions, and discuss when and why you might use each. By the end, you’ll have a clearer picture of which type of accounting works best for your business.

What is Managerial Accounting?

Managerial accounting, sometimes called management accounting, focuses on providing financial information that managers and executives use to make decisions within the company. Unlike financial accounting, which produces reports for external parties like investors, managerial accounting is all about helping internal stakeholders—such as company managers, department heads, and operations teams—improve business operations and strategies.

The goal of managerial accounting is to provide detailed insights into costs, profits, and financial trends that impact day-to-day decisions. It’s less about adhering to strict accounting rules and more about tailoring data to the needs of the business. This type of accounting is especially helpful for cost control, budgeting, and strategic planning.

Key Features and Goals

- Internal Focus: Managerial accounting reports are designed for internal use rather than external review.

- Customizable Reports: There are no mandated formats. Reports can be adjusted to meet specific business needs, such as focusing on product lines, geographical regions, or departments.

- Future-Oriented: Managerial accounting often involves forecasting and planning. It looks ahead to predict future performance rather than just reviewing past results.

- Non-Standardized Data: The reports are highly flexible and don’t need to comply with external standards like GAAP (Generally Accepted Accounting Principles) or IFRS (International Financial Reporting Standards).

Types of Reports Generated

- Budget Reports: Helping businesses plan and control costs.

- Variance Analysis Reports: Showing the difference between planned and actual performance.

- Cost Analysis Reports: Breaking down the costs associated with producing products or delivering services.

- Break-even Analysis: Determining the sales volume required to cover costs.

Target Audience

Managerial accounting reports are primarily used by company insiders, particularly managers, executives, and department heads. These reports help them make informed decisions about production, pricing, operations, and budgeting.

What is Financial Accounting?

On the other hand, financial accounting is focused on creating financial statements for external stakeholders. These include investors, creditors, regulators, and tax authorities. The goal of financial accounting is to present a clear and standardized view of a company’s financial health and performance over a specific period.

Financial accounting is bound by established rules and principles, ensuring that reports are consistent, transparent, and comparable across companies and industries. These standards, such as GAAP and IFRS, make sure that businesses report financial information in a way that external parties can trust.

Key Features and Goals

- External Focus: Financial accounting is all about creating reports that give a broad view of the business’s financial status to external parties.

- Standardized Reports: These reports follow strict guidelines, ensuring consistency and comparability across different businesses.

- Historical Data: Financial accounting primarily looks at past performance rather than future projections.

- Compliance-Oriented: Reports must comply with accounting standards and regulations, often subject to external audits.

Types of Reports Generated

- Income Statements: Showing a company’s revenue and expenses over a period.

- Balance Sheets: A snapshot of a company’s assets, liabilities, and equity at a specific point in time.

- Cash Flow Statements: Detailing the cash inflows and outflows from business activities.

- Statement of Shareholders' Equity: Displaying changes in ownership interest over time.

Target Audience

Financial accounting reports are used by external stakeholders, including investors, creditors, regulators, and tax authorities. These users rely on the financial statements to assess the financial performance, stability, and liquidity of a business.

Key Differences Between Managerial Accounting and Financial Accounting

Now that we have a solid understanding of both, let’s explore the key differences between managerial accounting and financial accounting. While both play critical roles in a business, they differ in focus, purpose, and how they approach financial data.

|

Category |

Managerial Accounting |

Financial Accounting |

|

Purpose |

Assists managers in decision-making for internal use. |

Provides a financial summary for external stakeholders. |

|

Time Orientation |

Future-oriented, focusing on forecasts and predictions. |

Historical, focusing on past performance. |

|

Regulations/Standards |

No standardized format; reports are customized to internal needs. |

Must comply with standards like GAAP or IFRS. |

|

Level of Detail |

Highly detailed, often focusing on segments or individual departments. |

Summary-level reports giving a high-level view of the entire business. |

|

Frequency of Reports |

Often produced frequently (daily, weekly, monthly) based on business needs. |

Typically produced quarterly or annually. |

|

Audience |

Internal stakeholders (managers, executives). |

External stakeholders (investors, regulators, etc.). |

Focus and Objectives

- Managerial accounting is primarily concerned with providing information to managers to help with decision-making, budgeting, and performance improvement.

- Financial accounting, by contrast, is aimed at providing a transparent view of the company’s finances to people outside the company, like investors or regulators.

Time Orientation

- Managerial accounting tends to be forward-looking, focusing on forecasts, budgets, and projections that help shape future decisions.

- Financial accounting, on the other hand, is backward-looking, focusing on past performance and presenting data from previous periods.

Compliance and Standards

- Managerial accounting doesn’t follow any fixed rules or guidelines. Reports can be customized to meet internal needs.

- Financial accounting is required to adhere to standards like GAAP or IFRS, ensuring that reports are comparable and reliable for external users.

Level of Detail

- Managerial accounting reports are granular, breaking down data into small segments that focus on specific areas like departments or products.

- Financial accounting reports are more summarized, giving a broad overview of the company’s financial status.

Frequency of Reports

- Managerial accounting reports are produced on a regular and frequent basis—sometimes daily, weekly, or monthly—depending on the internal needs of the business.

- Financial accounting reports, however, are typically generated quarterly or annually for formal filing purposes.

Benefits of Managerial Accounting

How it Helps in Decision-Making

Managerial accounting plays a pivotal role in improving the quality of decisions made within a company. It helps managers:

- Identify costs and revenues associated with specific activities or departments.

- Allocate resources more effectively based on detailed financial insights.

- Make informed strategic decisions that enhance operational efficiency and profitability.

Cost Control and Budgeting

One of the key areas where managerial accounting excels is in helping businesses control costs. By identifying where money is being spent, companies can make adjustments to stay within budget. Managerial accounting also assists in the budgeting process, helping managers forecast future expenses and revenue streams.

Real-Time Data Analysis

Managerial accounting allows businesses to analyze data in real-time, providing managers with up-to-date information that helps them make timely and informed decisions. This proactive approach can be crucial for responding quickly to changes in the market or the business environment.

Benefits of Financial Accounting

Stakeholder Communication

Financial accounting serves as a bridge of communication between a business and its external stakeholders. By producing standardized and comparable financial statements, companies can build trust with investors, lenders, and other external parties.

Legal and Regulatory Compliance

Financial accounting helps businesses remain compliant with legal and regulatory requirements. Adhering to GAAP or IFRS ensures that companies provide transparent and accurate financial information, which can be critical for avoiding penalties and maintaining a good reputation.

Performance Evaluation

Financial statements provide a comprehensive picture of a company’s financial performance over a specific period. Investors and analysts can use this data to evaluate the company’s profitability, liquidity, and solvency, allowing them to make better investment decisions.

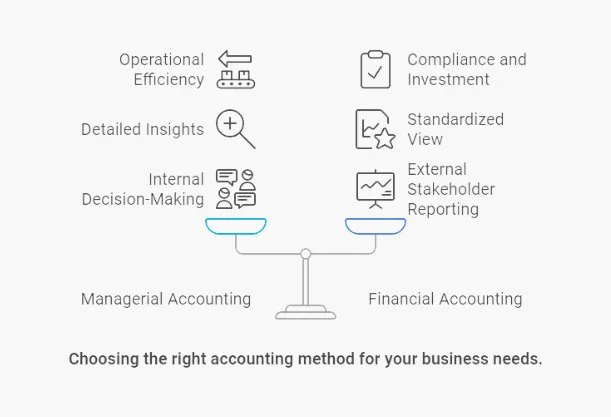

Which One Should You Choose?

When to Use Managerial Accounting

If you’re focused on internal decision-making and

need detailed insights to help guide operational and strategic decisions, managerial accounting is the way to go. It’s particularly useful for:

- Cost management and improving operational efficiency.

- Performance evaluation of individual departments or projects.

- Planning and forecasting future financial outcomes.

When to Rely on Financial Accounting

If your main goal is to provide a clear and standardized view of your company’s financial performance to external stakeholders, financial accounting is the best option. It’s essential for:

- Securing investment or loans by showing external parties how your business is performing.

- Ensuring compliance with legal and regulatory standards.

- Evaluating overall company performance and making sure your company stays financially healthy.

How Both Can Work Together

While managerial and financial accounting serve different purposes, they are not mutually exclusive. In fact, they can complement each other. A business can use managerial accounting to manage internal operations effectively while using financial accounting to communicate with external parties. For a well-rounded financial strategy, using both types of accounting ensures that you have all the data you need to make informed decisions and meet stakeholder expectations.

Conclusion

In summary, both managerial accounting and financial accounting have vital roles in any business, but they cater to different needs. Managerial accounting helps internal teams make decisions and improve efficiency, while financial accounting communicates the company's overall performance to external stakeholders.

Which one works for your business? The answer depends on your specific needs. For internal management, managerial accounting will give you the detailed insights you need. If you’re looking to comply with regulations and show your company’s financial health to external parties, financial accounting is essential.

Both approaches work best when used together, ensuring a comprehensive financial view that supports both internal operations and external reporting.

Rohit Kapoor

Rohit Kapoor