Series A Valuations in 2025: What Founders Need to Know

Raising Series A funding is a crucial milestone for startups. It signifies that a company has proven its concept, established early traction, and is ready to scale. But one of the biggest questions founders face is: What is my startup worth at Series A?

Valuations at this stage are both an art and a science. Market conditions, investor sentiment, financial metrics, and industry trends all play a role. In 2025, with an evolving economy and emerging technologies shaping venture capital (VC) trends, understanding Series A valuations is more important than ever.

This guide will break down everything founders need to know about Series A valuations in 2025, including:

- How valuations are determined

- What investors are looking for

- How to calculate Series A valuation

- Typical funding structures

- Mistakes to avoid and strategies to maximize your valuation

If you're preparing for your Series A round, this guide will help you navigate the landscape and position your startup for success.

What Is Series A Valuation?

Definition and Purpose

Series A valuation is the estimated worth of a startup at the time of raising its first institutional round of venture capital. It represents how much investors believe the company is worth based on its growth potential, revenue, traction, and market size.

Seed vs. Series A Valuations: Key Differences

| Factor | Seed Round | Series A Round |

| Stage | Early-stage, concept validation | Growth-stage, scaling the business |

| Revenue | Usually pre-revenue or minimal revenue | Demonstrated revenue and customer traction |

| Funding Size | $500K - $3M | $5M - $20M+ |

| Valuation | $2M - $15M | $10M - $100M+ |

| Investor Type | Angel investors, pre-seed VCs, accelerators | Institutional VCs, larger venture firms |

Unlike the seed stage, where valuations are often based on potential, Series A valuations rely more on metrics, traction, and market validation.

What Is a Good Series A Valuation Amount?

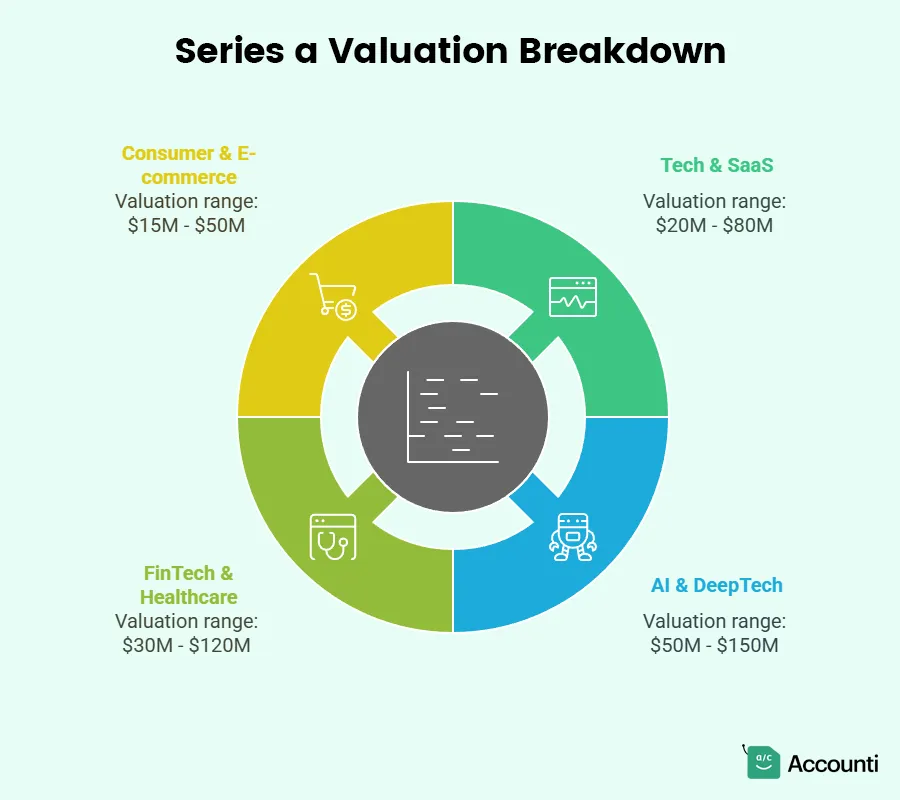

In 2025, a good Series A valuation varies depending on the startup's industry, revenue, growth rate, and competitive landscape.

- Tech & SaaS startups: $20M - $80M

- AI & DeepTech: $50M - $150M

- FinTech & Healthcare: $30M - $120M

- Consumer & E-commerce: $15M - $50M

Valuations depend on how well the startup justifies its growth potential to investors.

How to Calculate Series A Valuation

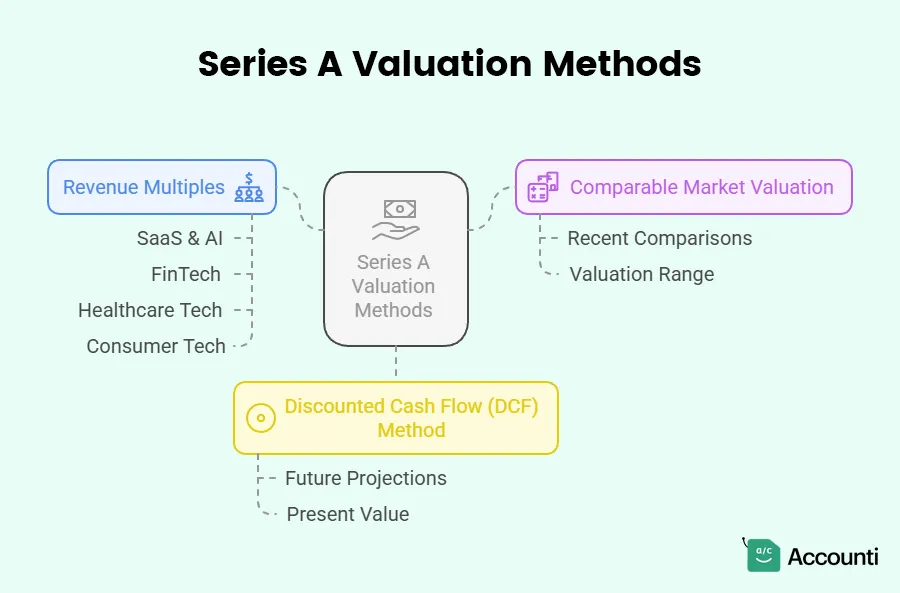

Valuations are typically calculated using a combination of financial models, market conditions, and investor expectations. Here are the most common methods:

1. Revenue Multiples

Venture capitalists often use revenue multiples to estimate valuation.

Valuation=Annual Revenue×Revenue Multipletext{Valuation} = text{Annual Revenue} times text{Revenue Multiple}

| Industry | Typical Revenue Multiple (2025) |

| SaaS & AI | 10x - 30x ARR |

| FinTech | 12x - 25x ARR |

| Healthcare Tech | 8x - 20x ARR |

| Consumer Tech | 5x - 15x ARR |

Example:

If a SaaS startup has an

Annual Recurring Revenue (ARR) of $3M and a

20x multiple, its Series A valuation could

be $60M.

2. Comparable Market Valuation

VCs compare your startup to similar companies that raised Series A funding. If a similar AI startup raised at a $50M valuation, yours may be in the same range.

3. Discounted Cash Flow (DCF) Method

This method projects future revenue and discounts it to today's value. However, early-stage startups often lack long-term revenue data, making this method less common for Series A.

How Does Series A Funding Work?

Typical Series A Funding Round Structure

| Component | Details |

| Investment Size | $5M - $30M+ |

| Equity Given Up | 15% - 30% |

| Investor Type | Venture capital firms, institutional investors |

| Purpose | Scaling operations, hiring, market expansion |

Most Series A rounds involve VCs leading the round, followed by smaller investors filling in the rest.

Investor Expectations in 2025

What are investors looking for in a Series A company?

- Revenue Growth - Strong MRR/ARR growth (3x+ YoY).

- Product-Market Fit - Clear customer demand and traction.

- Scalability - A business model that can grow efficiently.

- Strong Unit Economics - Low churn, high customer LTV.

- Competitive Edge - Proprietary technology, unique market approach.

Pre-Seed vs. Series A Funding: Key Differences

| Stage | Pre-Seed | Series A |

| Funding Size | $100K - $2M | $5M - $30M+ |

| Investors | Angels, accelerators | VCs, institutional funds |

| Focus | Idea validation | Scaling growth |

| Revenue | Usually pre-revenue | Established revenue & metrics |

How to Prepare Your Financials for Fundraising

Financial preparedness can make or break your Series A fundraising process. Investors want clean, transparent financials that justify your valuation.

Essential Documents to Prepare

✔

Profit & Loss Statement (P&L)

- Last 12 months of revenue & expenses.

✔ Balance Sheet - Assets, liabilities, and

equity structure.

✔ Cash Flow Statement - Monthly burn rate

and runway.

✔ Financial Projections - 3-5 years of

growth forecasts.

✔ Cap Table - Ownership breakdown and

dilution analysis.

Startups that present clear, investor-friendly financials have a higher chance of securing strong valuations.

Mistakes to Avoid in Series A Fundraising

- Overvaluing Your Startup - High valuations can scare investors.

- Ignoring Dilution - Ensure you're aware of how much equity you're giving up.

- Weak Financial Projections - Investors want realistic, data-backed numbers.

- Relying on One Investor - Always diversify interest to improve leverage.

Future Predictions: Where Are Series A Valuations Headed?

1. More AI-Driven Valuations

Investors are increasingly using AI-powered due diligence tools to evaluate startups.

2. Higher Valuations in AI, FinTech & Healthcare

Startups in AI, automation, and biotech may receive higher Series A valuations due to increased investor interest.

Conclusion

Series A valuations in 2025 will be shaped by market trends, investor expectations, and a startup's ability to demonstrate growth. Founders should:

- Focus on scaling revenue and unit economics.

- Ensure strong financial preparation.

- Avoid valuation mistakes that can hurt fundraising.

With the right strategy, founders can maximize their valuation and attract top-tier investors.

FAQs

How much equity should founders have at Series A?

At the Series A stage, it's common for founders and employees to retain approximately 50% ownership of the company. This allocation ensures that the founding team maintains significant control and motivation while providing sufficient equity to attract investors and key employees.

How do you value a Series A company?

Valuing a Series A company involves several methods:

- Comparable Company Analysis: Comparing the startup's metrics to similar companies that have recently raised funds.

- Discounted Cash Flow (DCF): Estimating the present value of expected future cash flows.

- Market Multiples: Applying industry-specific multiples to the company's financial metrics.

These methods provide a comprehensive view of a startup's valuation by considering both current performance and future potential.

What is a good Series A valuation?

A favorable Series A valuation typically ranges between $10 million and $15 million. However, this can vary based on factors such as market conditions, industry trends, and the startup's traction and revenue. Achieving a higher valuation often depends on demonstrating strong growth potential and a clear path to profitability.

What do Series A investors look for?

Series A investors prioritize the following:

- Product-Market Fit: Evidence that the product or service meets a significant market need.

- Scalable Business Model: A framework that allows for growth without a proportional increase in costs.

- Strong Team: A capable and experienced team poised to execute the business plan effectively.

- Market Opportunity: A large and growing market that offers substantial potential for expansion.

Investors assess these factors to gauge the startup's potential for success and return on investment.

How risky is Series A funding?

Series A funding carries inherent risks for both founders and investors. For investors, the primary risk lies in the startup's potential failure, which could result in a total loss of the investment. Founders face the possibility of significant equity dilution and the pressure to meet growth expectations. Despite these risks, Series A funding is crucial for startups aiming to scale operations and achieve market penetration.

What do VCs look for in founders?

Venture capitalists (VCs) often seek the following traits in founders:

- Visionary Leadership: The ability to articulate a clear and compelling vision for the company's future.

- Resilience: Demonstrated capacity to navigate challenges and setbacks effectively.

- Relevant Experience: Background and expertise pertinent to the industry and business model.

- Adaptability: Willingness to pivot and adjust strategies in response to market feedback and changing conditions.

VCs assess these qualities to determine a founder's potential to lead the company to success and generate substantial returns on their investment.

Rohit Kapoor

Rohit Kapoor