How to Solve for Retained Earnings (Simple Guide, Formula & Examples)

In the world of finance and accounting, few metrics are as crucial yet often misunderstood as retained earnings.

Whether you're a budding entrepreneur, a seasoned investor, or simply someone looking to enhance their financial literacy, understanding how to solve for retained earnings is a valuable skill.

This article will dive deep into the concept, calculation, and significance of retained earnings, providing you with the knowledge to navigate this essential aspect of financial analysis.

What are Retained Earnings?

Retained earnings represent the cumulative net income a company has earned over its lifetime, minus any dividends paid to shareholders.

In essence, it's the portion of profits that a company chooses to keep and reinvest in the business rather than distribute to its owners.

This financial metric plays a pivotal role in a company's financial statements, offering insights into its profitability, growth strategy, and overall financial health.

By examining retained earnings, we can gauge a company's ability to fund expansion, weather economic downturns, and create long-term value for shareholders.

Connection to Company Growth and Reinvestment

Retained earnings are intrinsically linked to a company's growth trajectory and reinvestment strategies. When a business chooses to retain its earnings rather than distribute them as dividends, it's often a signal of confidence in future growth opportunities.

These funds can be channeled into various avenues such as:

- Research and development

- Expansion into new markets

- Upgrading technology and infrastructure

- Paying off debt

- Acquiring other businesses

By understanding how to solve for retained earnings, we gain valuable insights into a company's financial strategy and its potential for future success.

Understanding the Concept of Retained Earnings

Definition and Explanation

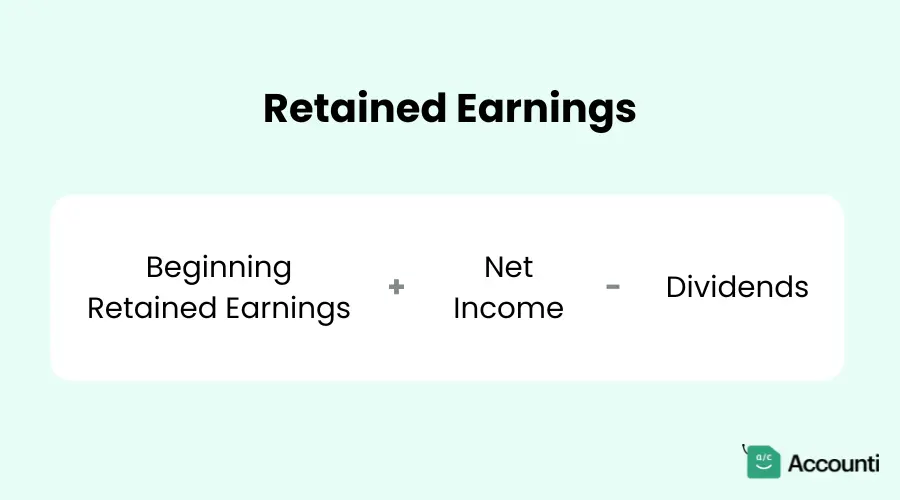

At its core, the concept of retained earnings is straightforward. It represents the accumulation of a company's profits over time, minus any dividends paid out to shareholders. The basic formula for calculating retained earnings is:

Let's break down each component:

- Beginning Retained Earnings - This is the retained earnings balance from the previous accounting period.

- Net Income - The company's total profits for the current accounting period.

- Dividends - Any distributions made to shareholders from the company's profits.

This formula provides a snapshot of how much profit a company has chosen to reinvest in itself rather than distribute to its owners.

Why Retained Earnings Matter

Retained earnings are more than just a number on a balance sheet. They serve as a critical indicator of a company's financial health and growth potential. Here's why they matter:

- Financial Health - A consistent increase in retained earnings over time typically signals strong and sustainable profitability.

- Growth Potential - High retained earnings can indicate that a company has ample resources to fund future growth initiatives.

- Dividend Sustainability - By comparing retained earnings to dividends paid, investors can assess the sustainability of a company's dividend policy.

- Financial Flexibility - Robust retained earnings provide a buffer against economic downturns and unexpected expenses.

When compared to other financial metrics, retained earnings offer unique insights. While metrics like revenue or net income provide snapshots of a company's performance over a specific period, retained earnings offer a cumulative view of a company's profitability over its entire lifespan.

How to Calculate Retained Earnings

Gathering Financial Information

Before we dive into the calculation process, it's crucial to gather the necessary financial information. You'll need:

- Beginning Retained Earnings

- Net Income

- Dividends Paid

These figures can typically be found in a company's financial statements. The beginning retained earnings are usually listed on the previous year's balance sheet. Net income is reported on the income statement, while dividends paid can be found in the cash flow statement or the statement of shareholders' equity.

Step-by-Step Calculation Process

Now that we have our key components, let's walk through the calculation process:

- Start with the beginning retained earnings balance.

- Add the net income (or subtract net loss) for the current period.

- Subtract any dividends paid to shareholders.

Let's illustrate this with an example:

Suppose Company XYZ has the following financial information:

- Beginning Retained Earnings: $500,000

- Net Income for the year: $200,000

- Dividends Paid: $50,000

Using our formula:

Retained Earnings = $500,000 + $200,000 - $50,000 = $650,000

Therefore, Company XYZ's retained earnings at the end of the period would be $650,000.

It's worth noting that in some cases, you may need to adjust for additional factors such as prior period adjustments. These could include corrections of accounting errors from previous periods or changes in accounting policies.

Common Mistakes to Avoid

When solving for retained earnings, be wary of these common pitfalls:

- Misinterpreting Net Income: Ensure you're using net income, not gross income or revenue.

- Overlooking Dividends: Don't forget to subtract all dividends paid, including both common and preferred stock dividends.

- Ignoring Prior Period Adjustments: These can significantly impact retained earnings and should be accounted for when applicable.

Practical Applications of Retained Earnings

Reinvestment in the Business

One of the primary uses of retained earnings is reinvestment in the business. Companies often use these funds to fuel growth initiatives such as:

- Expansion: Opening new locations or entering new markets.

- Research and Development: Investing in new products or improving existing ones.

- Debt Repayment: Reducing financial leverage and improving the balance sheet.

For example, tech giant Apple Inc. has historically maintained high levels of retained earnings, using these funds to finance continuous innovation in its product line and expand its services ecosystem.

Retained Earnings vs. Dividends

The decision to retain earnings or distribute them as dividends represents a crucial balancing act for many companies. Retaining earnings allows for reinvestment and potential future growth, while paying dividends provides immediate returns to shareholders.

Consider the case of Coca-Cola Company. Known for its consistent dividend payments, Coca-Cola balances shareholder returns with reinvestment.

In 2020, despite challenging market conditions, the company paid out $7 billion in dividends while retaining earnings to maintain financial flexibility and fund ongoing operations.

Impact of Retained Earnings on Financial Statements

Balance Sheet

On the balance sheet, retained earnings appear in the shareholders' equity section. They represent a key component of a company's book value, alongside other items like common stock and additional paid-in capital.

Here's a simplified example of how retained earnings might appear on a balance sheet:

Shareholders' Equity

Common Stock: $1,000,000

Additional Paid-in Capital: $500,000

Retained Earnings: $2,500,000

Total Shareholders' Equity: $4,000,000

Income Statement

While retained earnings don't appear directly on the income statement, there's a strong connection between net income (the "bottom line" of the income statement) and retained earnings.

Net income flows into retained earnings, increasing the balance when positive and decreasing it when negative.

Statement of Retained Earnings

The statement of retained earnings provides a detailed view of the changes in retained earnings over a specific period. It typically includes:

- Beginning retained earnings balance

- Net income or loss for the period

- Dividends paid

- Any adjustments to retained earnings

- Ending retained earnings balance

Here's an example of a simple statement of retained earnings:

Statement of Retained Earnings for Year Ended Dec 31, 2023

Beginning Retained Earnings: $500,000

Net Income: $200,000

Less: Dividends Paid: ($50,000)

Ending Retained Earnings: $650,000

Solving Retained Earnings Challenges

Addressing Negative Retained Earnings

Negative retained earnings occur when a company's cumulative losses exceed its cumulative profits. This can happen due to:

- Consistent operating losses

- Large dividend payments exceeding profits

- Share buybacks that exceed the balance of retained earnings

Overcoming negative retained earnings typically involves:

- Improving profitability through cost-cutting or revenue growth

- Reducing or suspending dividend payments

- Issuing new shares to raise capital

Retained Earnings in Startups vs. Established Companies

The approach to retained earnings often differs between startups and established companies:

Startups :

- Often have negative retained earnings initially due to startup costs and early losses

- Focus on growth rather than profitability in early stages

- May not pay dividends, instead reinvesting all profits back into the business

Established Companies :

- Generally have positive retained earnings built up over years of operation

- Balance growth investments with shareholder returns through dividends

- May use retained earnings to fund acquisitions or major capital expenditures

Conclusion

Understanding how to solve for retained earnings is a crucial skill in financial analysis. It provides insights into a company's profitability, growth strategy, and overall financial health.

By mastering this concept, you'll be better equipped to evaluate investment opportunities, assess a company's financial stability, and understand its long-term growth potential.

Remember, retained earnings are more than just a number on a balance sheet. They represent a company's cumulative profits reinvested for future growth.

Whether you're an investor, manager, or financial professional, the ability to calculate and interpret retained earnings will serve you well in your financial endeavors.

Regularly monitoring retained earnings, along with other key financial metrics, can provide a comprehensive view of a company's financial performance and prospects.

As you apply this knowledge, you'll gain a deeper understanding of how companies balance growth initiatives with shareholder returns, ultimately driving sustainable long-term value.

Rohit Kapoor

Rohit Kapoor